NEWS ARCHIVE - January 2015

January 30, 2015

Katrougkalos: illegal dismissals are withdrawn - Ethnos.gr[Translation via Google translate]Mr. Katrougalos [Deputy Minister of Administrative Reform], in statements after meeting with representatives of civil servants, stressed that "we need a new state, a more democratic society this is more open, and more efficient. And we can not build this new state without civil servants. "

Noting that "the last time it happened a demonization of civil servants," the deputy minister, giving the position of the new government, said that "any system that wants to justify some sort of misery constructs the image of a civil servant as internal enemy supposedly to blame for most problems "and said:" You are going to change this picture. We will work with the civil servant... we trust in human resources of public administration, we will have confidence and its representatives, and will not leave things as they are. "

He noted that "the reason why Greek society, at the moment has a public administration that is not worth it, is because of political patronage and the patronage state, cronyism ...by the operation of current government " he added:" These policies will stop. "

Eurozone breakup threat reaches all-time high - UK Telegraph

"The new government has implemented new policies in a matter of days that run contrary to the structural reforms they have been required to implement. Measures have included an increase of the minimum wage and the cancellation of privatisation plans for a power company and ports.

“Greece has very tough negotiations ahead,” Mr Von Gerich said. “If Syriza is seen to be able to change the terms of Greece’s adjustment programmes, the spill-over effects could be sizeable in many other countries, which would add to euro area political risks.”

If neither party is willing to blink, then a 'Grexit' may result, which economists fear could add momentum to populist parties in other eurozone states. Bookmaker Paddy Power offers 6/4 odds on a Greek exit by the end of 2016. "

More about the Economy of Greece

Greece: Putin's new ally in Europe? - CNN Money

Greece's government, led by left-wing party Syriza, has started to unpick reforms that were crucial to securing €240 billion ($272 billion) in European and IMF funds keeping the country afloat. Relations between Russia and the EU are the worst they've been since the Cold War due to the Ukraine crisis.

Congratulating Greek Prime Minister Alexis Tsipras on his victory, Russian President Vladimir Putin said he was confident the two countries would "work together effectively to resolve current European and global problems."

Greece seems receptive to closer links. Tsipras reportedly met with the Russian ambassador hours after taking office, and with Russian officials last May.

Greece and its discontents - Economist

"...The early antics of Alexis Tsipras, the new Greek prime minister, spooked markets and again raised fears of Grexit. But the channels of contagion have narrowed, thanks to a partial banking union, a permanent bail-out fund and a restructuring of Greek debt, most of which is now in official hands. Investors at last seem to agree that Spain is Spain, not Greece.

Yet voters may be drawing a different conclusion. Over the past year the growth of Syriza in Greece has been mirrored by the rise of Podemos (“We Can”) in Spain, a radical far-left party that considers itself to be waging a similar war on German-sponsored austerity. Leftists from across Europe flocked to Greece on election night to savour the sweet taste of Syriza’s victory. Sympathetic pundits declared an end to the politics of austerity.

Mr Tsipras’s decision to form a coalition with an unsavoury bunch of nationalists soured the mood somewhat. But overall, the message seems clear: if financial contagion is now less of a worry, the political sort may just be starting. "

Greece Is Quickly Turning Into Europe's Worst Nightmare - Business Insider

"The biggest and immediate problem: Greece's veiled stand against new sanctions on Russia reveals how splintered the EU is becoming.

"The issue is that politics and economics in Europe are going to get worse," Bremmer told the Council of Foreign Relations. "The issue is that the perception of crisis is taking roots once again. The issue is that other parties of similar alignment are going to make gains, and the political cohesion of Europe is going to deteriorate even further."

That deterioration would also drive a wedge between the US and the EU.

"Many Europeans would love to have Greece take the flak for stepping out of line—and then get right behind them," Bremmer told BI. "Greek disapproval (even if it falls short of a veto) is one more pressure that could slowly pull apart European member states’ alignment on sanctions — and distance Europe further from the United States."/p>

Greece’s leftist government sparks fears of a Russian beachhead in Europe - Washington Post

“You have a lot of people asking themselves whether Greece is going to play the role of the Trojan horse,” said Ben Nimmo, a European security analyst and former NATO official. “But nobody really knows. And you have mixed messages coming out of the Greek government.”

Still, the prospect of a Russian beachhead inside Western alliances has stirred Cold War-style fears within European defense ministries this week.

For Syriza, challenging the E.U. stance on Russia reflects an ideology “that says we have to be skeptical of certain things our European partners do because the E.U. is a capitalist, neoliberal enterprise,” said Spyros Economides, an international relations professor at the London School of Economics."

January 29, 2015

9 reasons Greece's experiment with the radical left is doomed to failure - UK Telegraph"Popular mandates don’t mean a thing: Or at least not in the hard world of international finance. It really doesn’t matter that much, when push comes to shove, if your government won 35% of the vote or 65% per cent of the vote in a general election. You owe the money; you need to pay it back as agreed. Alexis Tsipras and his new cabinet will soon be told that.

The Greeks have no bargaining power: If they cannot scare the Germans into easing up because they can threaten the whole European project then they have nothing left to rely on for leverage. They have some sound arguments and seem more reasonable than was assumed by some, but in that is all they have to rely on."

Fed outlook and Greece worries hit stocks, dollar up - Reuters

"Greece, where a radical leftist prime minister took over on Monday, also kept investors nervous, although Greek shares regained some ground after falling 9.2 percent on Wednesday.

The Fed, after a two-day policy meeting, also said it would be "patient" and would take international developments into account in deciding when to raise borrowing costs -- a reference some in the markets saw as meaning any hike could be delayed.

German government bond yields fell, following similar declines in U.S. Treasuries, on this dovish view. U.S. 30-year bond yields US30YT=RR hit a record low on Wednesday."

Investors have woken up to Greece's nuclear risk - UK Telegraph

"Contrary to expectations, Mr Tsipras has not resiled from a long list of campaign pledges that breach the terms of Greece’s EU-IMF Troika Memorandum and therefore put the country on a collision course with Brussels and Berlin.

He told his cabinet he is willing to negotiate on demands for debt relief but will not abandon core promises. “We will not seek a catastrophic solution, but neither will we consent to a policy of submission,” he said.

If anything, he is upping the ante, going into coalition with a nationalist party even more hostile to the Troika, clearly gambling that Germany and the creditor powers will not let monetary union break apart at this late stage having already committed €245bn (£183bn), for to do so would shatter the illusion that the eurozone crisis has been solved.

“We will immediately stop any privatisation,” said Panagiotis Lafazanis, leader of the Marxist Left Platform, the biggest bloc in the Syriza pantheon. Plans to sell the PPT power utility and the Piraeus Port have been halted. The minimum wage will be raised from €500 to €751 a month as a first order business, an explicit rejection of Troika austerity terms."

Greece threatens EU veto over Russian sanctions - UK Independent

"The new Greek government is expected to veto further sanctions against Russia today, amid fears the radical left-wing party could be moving closer to the Kremlin.

Syriza’s dynamic young leader Alexis Tsipras, who stormed to victory in Greek elections on Sunday, appears to be threatening to veto when EU foreign ministers gather in Brussels for an emergency meeting over Russia’s alleged actions in Ukraine."

China media warn new Greek government over port - Asia One

"Tsipras' "national salvation" government said it was putting on hold the previous administration's plans to sell a majority stake in the ports of Piraeus and Thessaloniki, and would also halt the privatisation of the top electricity and petroleum companies.

China's giant COSCO group is among the bidders for Piraeus, one of Europe's busiest ports, and the review has unnerved some in the Chinese government. COSCO already has a 35-year concession to expand the two main container terminals at the port, and both Chinese President Xi Jinping and Premier Li Keqiang visited Greece last year.

"We are highly concerned about this," Beijing's commerce ministry spokesman Shen Danyang said Thursday.

...Syriza has promised to reverse many of the reforms implemented by the previous conservative government, including a host of privatisations.

The previous administration of Antonis Samaras had backed the reforms as part of the conditions of a 240 billion euro (S$366 billion) EU-IMF bailout."

January 28, 2015

Varoufakis: Greek democracy today chose to stop going gently into the night. - CSM"...Varoufakis was appointed Greece’s finance minister on Tuesday by Alexis Tsipras, the former communist who a day earlier was sworn in as the country’s youngest prime minister after his radical leftist Syriza party won a resounding victory in the national election.

...Varoufakis, who left a post at the University of Texas to take the position in Greek government, hailed Syriza’s election win on Sunday as a new dawn.

Paraphrasing the Welsh poet Dylan Thomas, he wrote on his blog: “Greek democracy today chose to stop going gently into the night. Greek democracy resolved to rage against the dying of the light. The people of Greece ... used the ballot box to put an end to a self-reinforcing crisis that produces indignity in Greece and feeds Europe’s darkest forces.”

Varoufakis roundly condemned Europe's austerity policies, calling it a huge mistake to “unload the largest loan in human history on the weakest of shoulders...”

Greece Moves Quickly to Roll Back Austerity - WSJ

"Late Tuesday, the government’s alternate merchant marine minister said that the planned sale of the state’s 67% stake in the main port of Piraeus had been halted, while the country’s new energy minister said Wednesday that Greece would freeze the planned restructuring and sell off the country’s dominant, state-controlled utility company.

In separate remarks Wednesday, Greece’s public sector reform minister, meanwhile, told morning television that the government would reverse some of the thousands of layoffs imposed as part of the bailout.

Since winning Sunday’s election, Mr. Tsipras’ government has set itself on a confrontation course with the European Union, moving forward to try to fulfill its campaign promises.

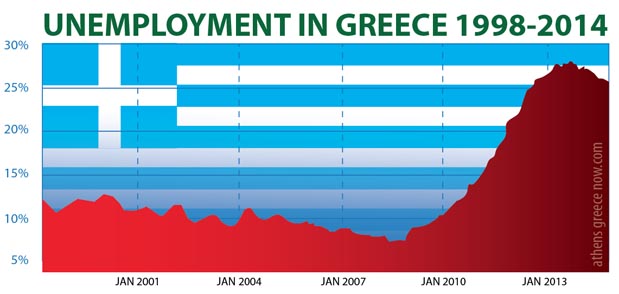

His Syriza party and its smaller coalition partner have vowed to roll back the austerity demanded by international creditors in exchange for the €240 billion rescue package that has resulted in one in four Greeks being out of work and the economy shrinking by about 25%. About 60% of Greece’s government debt is owned by eurozone countries."

New decisions coming quickly - Hiking The Minimum Wage - Business Insider

"The incoming government in Athens is already making waves: Greece's minimum wage will be hiked by 10%, to about €750 per month from about €680.

That's according to Syriza's new labor minister, speaking to the Greek TV station Skai.

It's not the only big change the new leadership is moving quickly on.

The government had previously been planning the sale of two-thirds of the Port of Piraeus, Greece's largest seaport. But that was immediately halted Tuesday, according to Reuters."

January 27, 2015

Greece's odd-couple coalition agrees only on ending cuts - Chicago Tribune"The two men disagree on just about everything, except this: for Greece, the time of German-dictated austerity must end.

Alexis Tsipras became prime minister of Greece on Monday by vowing to challenge the budget-cutting policies demanded by the European Union and International Monetary Fund in return for a 240 billion euro ($270 billion) rescue plan.

But his election win on Sunday, though emphatic, left the former communist short of a majority in parliament. To get one, he turned to the religiously inclined conservative party of Panos Kammenos. Their unlikely and potentially fragile coalition underscores how Greeks across the political spectrum have found a common cause after five years of austerity-fueled recession.

Tsipras and Kammenos, who took the post of defense minister, have both vowed to try to write down the country's debt, over the objections of the European Central Bank and IMF."

Syriza names hardline anti-bailout finance minister - Yahoo/AFP

"Greece named radical left-wing economist Yanis Varoufakis its new finance minister on Tuesday, giving him the mammoth task of leading negotiations with international creditors over the country's bailout.

The appointment of Varoufakis is seen as a signal that the new anti-austerity Syriza-led government will take a hard line in haggling over the 240-billion-euro ($269 billion) EU-IMF package.

The polyglot Varoufakis, 53, is a vocal critic of the conditions imposed on Greece in return for the bailout granted in 2010 and argues the country can never recover economically until they are relaxed."

Stage set for EU debt showdown - Zee News

"A day after being sworn-in as new Greece PM, leftist leader Alexis Tsipras will unveil the new cabinet on Tuesday.

In a shift from tradition, the 40-year-old leftist leader arrived for the swearing-in ceremony on Monday without a tie and instead of a religious oath, took a civil oath.

Shortly after election victory, he was quick to forge a coalition with as his party Syriza fell two seats short of the majority mark of 151. After it was made clear on Suday that his party had clinched poll victory, a buoyant Alexis addressed cheering supporters and heralded that Greece was leaving behind austerity that ruined the nation.

"Greece leaves behind the austerity that ruined it, leaves behind the fear, leaves behind five years of humiliation, and Greece moves forward with optimism and hope and dignity," he said as quoted by the CNN.

Having reeled under heavy budget cuts for years, Greek citizens have said a clear no to austerity by giving the maximum votes to the anti-bailout Syriza party, which joined hands with small right-wing Independent Greeks party to form the ruling coalition."

Greece’s Agonized Cry to Europe - NY Times

"...Mr. Tsipras must use his popular mandate to push through the fundamental domestic reforms that his predecessor, Antonis Samaras, had begun. The moneyed elites’ aversion to paying taxes must be brought to an end, along with the corruption, nepotism and cronyism in government. Opposing austerity does not mean abandoning reform as a group of prominent economists wrote recently in The Financial Times.

There is not a lot of time, though. Greece’s current bailout program expires on Feb. 28."

Greece’s Warning to the Rest of Europe - New Yorker

"Many people across Europe are hoping that Tsipras succeeds in ending austerity. Over the past five years, Greece has undergone an economic cataclysm that has seen its G.D.P. shrink by a fifth. One in four people is unemployed, and the child-poverty rate is forty per cent. This isn’t merely a recession; it is Greece’s own Great Depression. Elsewhere in the euro zone things aren’t quite that bad, but they’re still pretty dire, especially in countries on the southern periphery. In Spain, for instance, the unemployment rate is 23.7 per cent, not much lower than the rate in Greece. Throughout the euro zone as a whole, the jobless rate is 11.5 per cent, which is more than twice the rate in the United States.

Syriza’s rise to power indicates the political dangers facing the euro zone as a whole if some way can’t be found to restore prosperity.

And it isn’t just left-wing parties that are gaining ground. In France, the anti-immigrant National Front is surging, with polls showing that its leader, Marine Le Pen, has far more support than President François Hollande, who is up for reëlection in 2017. In Italy, the conservative Northern League is making a comeback under an assertive new leader, Matteo Salvini, who has coupled opposition to immigration with criticism of the euro. Even in Germany, there are signs of polarization, with far right-wing groups recently staging a series of anti-Islamist rallies."

Eight possible scenarios if Greece defaults and leaves the Eurozone - Economic Times

Brief laundry list of possible outcomes, starting with "meltdowns", bank-runs, and ending with a euro exit.

Being booted out of eurozone is in Greece’s interests - UK Express

"Syriza seems to take it for granted that Greece can remain a member of the eurozone, while unilaterally relieving itself of the terms of the bailout agreed with the EU in 2010.

In the short term the party may be proved right.

Such is the vanity of the central bankers and politicians who created the euro that they will do virtually anything to avoid admitting it was a mistake.

Syriza knows this and has calculated that however outrageous its demands the rest of the eurozone will roll over so that the euro can live another day.

What Syriza forgets is that other European countries have voters, too, and they are already angry at the quantity of their money which has already been shovelled in the direction of Athens."

January 26, 2015

Greece's Syriza seeks coalition partners after poll win - Charlotte Observer"Greece Greece's left-wing Syriza party prepared to launch coalition talks Monday, hours after a landmark general election victory fought on a pledge to rewrite the country's massive bailout deal with the eurozone.

Alexis Tsipras' party just missed a majority in parliament after defeating Prime Minister Antonis Samaras' conservative coalition by a wider margin than expected.

With 99.8 percent of the vote counted, Syriza had 149 seats in the 300-member parliament with 36.3 percent of the vote. The conservatives were on 27.8 percent, and the extreme right Golden Dawn party in third place with 6.28 percent."

More coverage:

Left-wing Syriza Party wins big in Greece's elections on Sunday - NY Daily News

Euro sinks to 11-week low after Syriza Win - The Week

Greece's radical left Syriza claims victory over austerity - France 24

First Order of Business for Greece's Winner: Compromise - NY Times

Add this to Greece's list of problems: It's an emerging hub for terrorists - CNN

"One analyst who has studied jihadist travel patterns says there are indications that militants are setting up logistical, recruitment and financial cells in Greece, in part to facilitate the travel of a growing number of would-be fighters traveling from Kosovo and Albania.

ISIS has produced several propaganda videos featuring Kosovars appealing to their countrymen to join them, and the Kosovo authorities believe some 200 individuals have left to wage jihad in Iraq and Syria.

But it's not just the Balkans that's providing the travelers.

"We estimate that about 2,000 people have used Greece in the last two years or so, mainly arriving by boat from Italy, as a stop to an onward journey," the source close to the intelligence services told CNN."

January 25, 2015

Greece's Syriza set to sweep election in anti-austerity triumph - Yahoo News"Greece's leftwing Syriza looked set for a comfortable victory over the ruling conservatives, an exit poll showed, with a chance of winning a full majority to face down international creditors and roll back years of painful austerity measures.

Syriza could gain 35.5-39.5 percent of the vote, well ahead of the conservative New Democracy party of outgoing Prime Minister Antonis Samaras on 23-27 percent, according a joint exit poll for Greek television stations issued immediately after voting ended.

If confirmed, the result would be enough to install 40-year-old Syriza leader Alexis Tsipras as prime minister at the head of the first euro zone government openly opposed to bailout conditions imposed by European Union and International Monetary Fund during the economic crisis.

The poll showed Syriza could have between 146-158 seats in the 300-seat parliament, with the final result heavily dependent on whether former Prime Minister George Papandreou's center Movement of Democratic Socialists enters parliament."

January 23, 2015

'Greece likely to need another bailout extension' - Economic Times

"Greece will likely have to ask for a fresh extension to its bailout programme because it expires on Feb. 28, a senior euro zone official said on Friday, stressing that a new government must first be in place to do so."

Austerity, Relief or Exit? - WS Journal

"Question: If a compromise can be found – enough reforms, enough austerity, enough debt relief – will Greece be saved?

Answer: Not necessarily. Since 2010, keeping the bailout program on track has proved even harder than agreeing its terms. The current program relies on optimistic growth and fiscal forecasts. And Syriza has yet to prove it can run a government and implement difficult overhauls. If the program goes off track again, creditors will demand extra austerity and reforms, which could push a Syriza government to breaking point—as happened to the Samaras government this winter. If Syriza cracks under the pressure, another round of uncertainty and early elections will follow, perhaps returning conservative New Democracy to power. "

Greece elections: Have 5 years of austerity paid off? - CNN Money

"Nearly five years on, Greece's economy is in better shape, but life for many Greeks is much worse. Unemployment has soared and wages have fallen even as people are working longer -- all of which are fueling demand for change.

The anti-austerity Syriza party is expected to win the election. The party has attracted significant public support on promises to renegotiate bailout terms and deliver relief to fed up Greeks. But victory for Syriza would cast doubt on the still fragile country's economic future."

From prison, Greece's Golden Dawn runs quiet but vitriolic campaign - Reuters

"With most of its top brass jailed pending trial on charges of being in a criminal gang, Greeks have seen little of one of Europe's most ardent anti-immigrant parties in recent weeks except for the occasional broadcast and odd leaflet.

Golden Dawn, whose leaders deny neo-Nazi sympathies, taps into the same anger at politicians seen as responsible for austerity, wage cuts and record unemployment that is expected to propel the radical leftist Syriza to power.

"...The television stations might present (our candidates) as knife-wielders, criminals, uneducated, immature but as you can see... they represent the best that Greek society has," boomed the voice of prominent Golden Dawn lawmaker Ilias Kasidiaris from a loudspeaker at a recent gathering in the town of Koropi, south east of Athens."

January 22, 2015

Soup kitchens and start-ups share Greece election anxiety - EuroNews"Constantinos Polychronopoulos lost his job four years ago. Since then he has created “The Other Human”, a charity which feeds the needy. In 2011 they provided 50-60 meals a day; four years later the figure is 450.

“No matter who gets elected, I will continue to be unemployed, I will continue to not have a single euro in my pocket. Therefore I don’t care if we use the euro or the drachma. I don’t have such dilemmas and there are some three to four million Greeks, half of Greece, like me,” Polychronopoulos said.

The possibility of the radical left SYRIZA party emerging victorious has raised the question of a potential a Greek exit from the euro.

This mistrust of the future is shared by small business owners, in particular those who were courageous enough to start their activities during the crisis. But they have plenty at stake, and what they fear is uncertainty."

January 21, 2015

Young Greeks who have never had a job ponder Sunday’s election - Euronews

"There have been warnings that some 100,000 Greek teenagers who have just turned 18 may not be able to vote in the weekend’s elections because there has not been enough time to register them.

Young people who are eligible could play a key role in the outcome.

The youth unemployment rate in Greece stood at 50.6 per cent in the autumn. For many the economic crisis has dominated their whole adult lives.

Giota Vamvaka walks hurriedly across the square. She was caught up at drama rehearsals at college and is late for work.

The 28-year-old has a bachelor’s degree in sociology, and is now doing a second degree in drama studies. But the job she is late for is not related to either, it is in a cafe in downtown Athens where she works part time as a waitress."

ECB Approves Emergency Liquidity Assistance for Four Banks - Greek Reporter

"Greece’s four biggest banks’ request to use the European Central Bank’s (ECB) Emergency Liquidity Assistance (ELA) has been approved for two weeks, according to reports. Any extension of the mechanism can be repeated in 15 days, during the next session of the ECB’s board of directors."

Will market turbulence begin again if Greece bows out of the EU? - Leaprate

"...with Greece sinking under the burden of national debt which was initially attributed to the ECB having been buying bonds in the open markets as a way of reducing the interest rate that Greece must pay on market borrowings.

Giving rise to a very dangerous fiscal practice was the period during which the ECB began taking Greek bonds as collateral against loans to entities such as the already struggling Greek banks. In turn, this was a precarious position, as if there is a devaluation of the bonds, the entire lot will all go bust immediately, leaving the ECB with that collateral which is now worth so much less than the loan against it that it will (near, maybe,) wipe out the ECB’s capital."

Tsipras Extends Syriza Olive Branch on Greece’s Economy - Bloomberg

"...Syriza leader Tsipras said his party will respect European Union fiscal rules and commit to targets on eliminating the deficit, in a further olive branch to the country’s creditors as he moves closer to winning power.

Tspiras, 40, writing in an op-ed published in today’s Financial Times, said Syriza will guarantee a “new social contract” including an end to austerity that will lead to “political stability and economic security.”

“A Syriza government will respect Greece’s obligation, as a eurozone member, to maintain a balanced budget, and will commit to quantitative targets,” Tsipras said.

Four days before a general election, polls suggest Syriza is poised to defeat Prime Minister Antonis Samaras’s New Democracy party."

January 20, 2015

Greece, new crisis stunts green shoots of hope - Reuters

æAs wages and prices have fallen in Greece after six years of economic crisis, companies have seen a slight uptick in demand and some firms have been able to seek new markets outside Greece and the euro zone. But the country remains a heavy importer, with companies catering largely to domestic clients.

"There was a general feeling that December would be a very good month," said Tzannes, as he walked past a glass case with 9,000-euro watches in one of his five Greek stores. "The first six or seven days were outstanding. But the rise vanished afterwards."

Greece's new bout of political uncertainty began in the second week of December when the government pushed forward a parliamentary vote to name a new president, triggering a set of events that led to early elections scheduled on Jan. 25.

"It was very unfortunate that the vote for president started in December, one of the most profitable months for retailers," said Dimitris Mardas, an economics professor at the University of Thessaloniki. "It was natural that people would hold back."

January 19, 2015

Tsipras: We will work only with those who accept the SYRIZA program - ethnos.gr[Translation via Google translate]"...Mr. Tsipras said that the stakes are not to beat SYRIZA, the stakes of these elections is to have an absolute majority in the next parliament.

"...we want to unite and not divide the Greek people, but we want an absolute majority in the next parliament because our opponent is not Mr. Samaras or Mr. Venizelos."

Our main rival, said the chairman of SYRIZA, "is a system of interlocking economic political powers, an establishment that all these years ruled the country, and we want our hands untied the next day so first we collide within the country for the changes that are necessary. "

Replying to a question concerning the negotiation of a government of SYRIZA with its partners, Mr. Tsipras said that the aim is this deal not last indefinitely, but the sooner the better end and for Greece but also for Europe .

On the fiscal policy that will follow, Mr.Tsipras said that government of SYRIZA will alleviate the situation for the lower class and the middle classes.

"Some are right to fear. You know who they are? Fraudsters and the clandestine and those with too high incomes."

Mystery of tomb deepens with body discoveries - UK Telegraph

"A vast tomb built in the time of Alexander the Great in Greece contains the ancient remains of five people, archaeologists announced on Monday, deepening the mystery as to who it was dedicated to.

Archaeologists unearthed bones from at least five people, including a woman aged over 60, a newborn baby, two men aged between 35 and 45 and another adult of indeterminate age. The bones of one of the men bore cut marks which were likely to have come from a sword or a dagger, the Greek culture ministry said, adding a new twist to the occupants of the necropolis.

The fifth person, whose gender and age has not been identified so far, had been cremated."

January 18, 2015

Coeuré: Any talk of a Grexit is unrealistic - To Vima"The European Central Bank executive board member Benoit Coeuré stressed that any talk of a “Grexit” is both "unreasonable and unrealistic", in an interview he gave to the Irish Times.

When asked about the ECB’s opinion on Alexis Tsipras’ proclamations, which some critics have argued may result in Greece being ousted from the Eurozone, Mr. Coeuré dismissed such a probability, while noting that the emergency ECB support for Greek banks depends on Greece remaining in an EU/IMF program.

Furthermore Mr. Coeuré clarified that the ECB is not a political institution and as such it will cooperate with the new Greek government to come to power in the upcoming elections."

Syriza Leads in Polls - WS Journal

"...A survey published Sunday in newspaper To Vima shows antiausterity party Syriza’s lead over the ruling New Democracy widening slightly to 3.1 percentage points from 2.5 percentage points a week earlier—the first time it has widened its lead since November.

In a separate poll published in newspaper Avgi, Syriza’s lead narrowed to five percentage points from eight a week earlier.

Greece’s coalition government—comprising New Democracy and its junior partner, the socialist Pasok party—was forced to conduct snap elections on Jan. 25 after Parliament failed in late December to agree on a new head of state."

Greece heads for a Euro collision - UK Telegraph

"Time and again, thousands of protesters have gathered in Syntagma Square in the heart of Athens to march against Greece’s agony of recession and austerity.

The streets nearby have been a theatre for so much unrest that broken windows go unnoticed and shops and doorways are permanently stained with Left-wing graffiti.

Yet after five years of economic crisis and countless demonstrations, Greeks will have the chance to seize back their destiny next Sunday when they vote in a snap general election.

Alexis Tsipras, the leader of the hard-Left Syriza party, says that Greece is being compelled to suffer “fiscal waterboarding”. At a rally last week, he declared that it was “time for the people, not foreign interests, to decide Greece’s future”.

All the evidence shows that the message of this 40-year-old populist is striking home. Every opinion poll for the past two months has put Syriza in first place with a consistent lead of between three and five percentage points. The latest survey showed the party widening its advantage, reaching 34.5 per cent compared with 29 per cent for New Democracy.

Unless there is a shock of earthquake proportions, Syriza is set to win this election – and Mr Tsipras will then become prime minister of Greece and one of the youngest national leaders in the world. "

Young Vote With Their Feet in 'City of Despair' - ND TV

"A regional hub on the border with Bulgaria, Drama and its environs have a jobless rate of 50 percent, local labour groups say.

The city once had 7,000 small businesses, mainly in the textile and timber sector. But many of those that were not wiped out by the economic crisis have moved across the border to where business costs are cheaper.

Today, even supermarkets in Drama have trouble hanging on to customers who prefer to shop in Bulgaria. "

Greece arrests four over Belgium terror plots - Times Israel

"At least four people were arrested in Athens on Saturday as part of a probe into a jihadist cell that was dismantled in Belgium this week before it could carry out any attacks, a Greek police source said

...European nations have arrested dozens of Islamist suspects in the wake of the Belgian anti-terror raids, during which two suspects were killed. Read more: Greece arrests four over Belgium terror plots."

More Coverage:

No link between Greece arrests and Belgium jihadists: prosecutor - Yahoo

Terrorism suspects may be linked to Belgium cell - Los Angeles Times

More about the Economy of Greece

January 17, 2015

Suspects held in Greece as European terror crackdown widens - Columbian

"With Europe on edge, soldiers fanned out Saturday to guard possible terror targets in Belgium while police in Greece detained at least two suspects as part of a widening counterterrorism dragnet across the continent.

A Greek police official earlier Saturday said the men were detained separately in Athens, some 1,500 miles from Brussels, and included an individual who at first sight matched the description of a key terror suspect in Belgium."

January 16, 2015

Investor Unease Hangs Over Greece Ahead of Vote -WS Journal"American billionaire Wilbur Ross bet the Greek economy was finally improving in April last year when he joined a group investing €1.33 billion ($1.55 billion) in lender Eurobank Ergasias SA .

The value of the investment has since fallen by a third, as markets have been shaken by Greek Prime Minister Antonis Samaras’s failure to win a parliamentary majority to elect a new president. That has triggered a snap general election on Jan. 25, which may open the door to left-wing firebrand Alexis Tsipras, who is leading in the polls.

...According to the latest data from Greece’s central bank, nonperforming loans, those for which debtors have failed to make payments for more than 90 days, total €77 billion.

Syriza has vowed to implement a law preventing banks from seizing the homes of people who have fallen behind on paying mortgages on primary residences valued at less than €300,000.

Mr. Ross said the policy is bad for Greek citizens, as well as for his Eurobank investment, because it will prevent the real-estate market and banking system from functioning."

It Might Be Time to Panic About Greece - Bloomberg

"Here's something that doesn't exactly cheer the soul: Greece's Eurobank Ergasias and Alpha Bank "have requested access to an emergency cash facility run by the central bank. Both said the moves were only a precaution and that neither faced an immediate funding crunch. ..."

It is especially cheerless when combined with two sentences from yours truly, penned a little over a week ago: "Exit may become a self-fulfilling prophecy. If people think it will happen, they will rush to withdraw their money from the financial system. The resulting collapse will force Germany to put more money in on easier terms, or Greece to leave the euro."

... I told readers to watch for signs of broadening panic, and this is just such a sign. So I thought it was worth pointing out."

Emergency Liquidity Assistance requested by Alpha Bank & Eurobank - WS Journal

"Two of Greece’s biggest lenders, Eurobank Ergasias and Alpha Bank , have formally requested access to an emergency cash facility run by the country’s central bank, amid concerns that liquidity conditions in Greece’s banking sector were tightening in the run-up to national elections later this month.

Banking officials from the two lenders said Friday that the moves were only a precaution and that neither faced an immediate cash crunch. “We have made an application to the central bank,” a senior executive at one of the banks said, “but it is strictly on a precautionary basis.”

Eurozone allots more time to Greece for repaying debt - India Economic Times

"Syriza will have to honour all Greek debts and continue reforms if it takes power but the euro zone might agree to wait longer to be repaid, officials in Brussels say.

The left-wing party led by Alexis Tsipras, which heads opinion polls nine days before elections, is pledging to negotiate a debt reduction and an end to budget austerity but says it is committed to keeping Greece in the euro zone.

"We are not considering debt write-offs," European Commission Vice President Valdis Dombrovskis told Reuters. "

January 15, 2015

The Left in Power? Greece Goes to the Polls - World Post

"What is Syriza, a party led by a forty-something male that states he is an atheist, whose political rise sends shivers through the markets and the EU leadership and revived the 'Grexit' bogeyman?

...Syriza, now an independent political party, was established a decade ago as a coalition of several sociopolitical forces ranging from the radical anti-capitalist far-left to more moderate environmental and feminist groups. During this period, Syriza unofficially assumed the mantle of the hardline anti-bailout mass movement which became the main driver of its surge as the recession and austerity cut deeper into Greek society. Opponents blamed Syriza of fomenting riots, implicit tolerance and even support of terrorist groups, and having a secret agenda for removing Greece from the euro and returning it to the drachma. Many people shrugged off these claims as groundless. What's certain is that they were never proven.

...what does the EU and the West have to fear from a left party and its leader, especially when he remains moderate and states his desire to retain Greece's European orientation?"

Greece - Europe's Economic Black Hole - National Interest

"Greeks will go to the polls on January 25. The outcome may lead to debt repudiation, other severe losses on assets and the beginning of the end of the common currency. Even if Europe avoids the worst, the best anyone can hope for is heightened levels of uncertainty. It is not a pretty picture, and the blame for this mess is so widespread that it would take a book just to name the people and institutions responsible.

It is entirely possible that Samaras will return to office. Syriza’s lead has already shrunk from double-digits not too long ago to only three percentage points according to some polls, well within their statistical margin of error. But even with a Samaras victory, uncertainties would remain..

...A Syriza victory, with its volatile leader, Alexis Tsipras, as prime minister, would open a myriad of possibilities, and there is no way to know what sort of agenda he might put in place. Over the last couple of years, he has talked out of so many sides of his mouth that Greeks going to the polls later this month really cannot know for what or against what they are voting."

Merkel says she wants Greece to stay in eurozone -Yahoo

"All my work in connection with the eurozone crisis was aimed and is aimed at strengthening the eurozone as a whole, with all its members, including Greece."

Much had been achieved towards this goal, she said, adding that the basis for all European efforts was always the principle of solidarity in return for individual efforts and responsibility.

"This principle continues to apply for us in the cooperation with every Greek government," Merkel said. "

Venizelos - we support cooperation with SYRIZA, not the program - ethnos.gr

[Translation via Google translate]"[While on Crete] "We are ready to support a government of national unity and wider cooperation. If SYRIZA will support the effort but not support the program for a national strategy, " said Mr. Venizelos.

Mr. Venizelos began his contacts with local officials to meet with representatives of Crete Activists of the Socialist Party but also executives of PASOK having a series of meetings.

Earlier answering questions from the newspaper New Crete whether "stressing the need for coalition government if SYRIZA seeks the cooperation of PASOK" but with "conditions" - "Will you do it?"

Mr. Venizelos replied:

"I insist firmly on what was already said in 2012: Government of all the democratic forces of the constitutional arc believe in a European perspective of the country. Those who want, those who can, who feel useful, can support the national effort. In this effort, there are no "conditions for SYRIZA" or "conditions for PASOK". There is one condition: a clear and responsible commitment for all to follow only a safe national strategy that takes us into the clear, in Europe, with the country still standing."

Will the Greek Election Ultimately Break the Euro? - Brookings

"If Syriza does manage to form a government, it will not have a large majority, and therefore there is a real possibility of the government falling apart under stress, either by losing its coalition partner or by losing the support of individual members of parliament. Syriza was formed from a number of smaller parties and has never been through the stresses and temptations of power.

...Assuming Syriza passes these hurdles, then one needs to analyze the two routes to Euro Crisis separately. The only way a failure of the Troika negotiations would be likely to have major effects in the rest of Europe would be if it produced an exit of Greece from the Euro.

...Withdrawal from the Euro would be much more serious, because it would set a precedent that might be used by other countries in the future.

In the unlikely event of a Greek exit, there would be significant damage to the European economy for at least the first year or so, but much of this could be offset by stepped up action by the ECB and by individual European governments. For its part, Greece would almost certainly dive back into a severe recession, due to major capital flight and huge uncertainties that would crush business investment and household spending. The disparity between the severity of the outcomes for the two sides is a major constraint on Syriza’s bargaining position.

..The second route from Greece to renewed Euro Crisis is longer and potentially less severe. It is also unlikely, although not as improbable as a Greek exit from the Euro. In this scenario, a new and stable Syriza government manages to “win” the negotiations with the Troika, forcing substantial and visible concessions. If the economy then picks up sharply for any reason Syriza could be covered in glory."

Centrist River party eyes third place in coming Greek general elections - China Xinhuanet

"The newly founded centrist River (Potami) party led by popular TV presenter Stavros Theodorakis eyes the third place in the upcoming Jan. 25 general elections in Greece, after the Radical Left SYRIZA party and the incumbent conservatives, according to the latest opinion surveys.

"We want to change everything without destroying the country" is the main slogan of the River party.

"New Democracy and SYRIZA should talk with the third political party in the country for all these that we can change together," Theodorakis said during a pre-election gathering at a Piraeus port district on Thursday evening.

"As they avoid the debate with us, we continue the open dialogue with people to exchange ideas," he added."

January 14, 2015

Greece Misses Target on Budget Surplus - Wall Street Journal"Greece announced a primary budget surplus of €1.9 billion ($2.24 billion) for 2014 on Wednesday, falling short of the target set for the year, in a miss largely due to a delay in the payment of its next tranche of aid.

The country’s primary budget surplus—which doesn’t take into account interest payments—for the January to December period reached €1.9 billion, missing a €4.9 billion target set by the Greek government and its international creditors.

According to the Finance Ministry, Greece has not collected €1.9 billion from the European Central Bank’s Securities Markets Program—a government-bond purchasing program."

The Politics Behind the ECB's Threat to Cut Greece Funding - Bloomberg

"The European Central Bank is threatening to choke off funding to Greece’s lenders in the hope it won’t actually need to.

Parliamentary elections on Jan. 25 hinge on whether Greek voters are willing to accept a strings-attached successor to the country’s international bailout package. Under President Mario Draghi, the Frankfurt-based ECB has made its position clear: No program means no guarantee of cash from us

Time is running out, with the current aid agreement with the European Commission, the ECB and the International Monetary Fund expiring at the end of February. Continuing to suspend normal collateral requirements assumes “a successful conclusion of the current review and an agreement on a follow-up arrangement,” the ECB said in a Jan. 8 statement. An arrangement such as an Enhanced Conditions Credit Line could be a difficult-enough negotiation for Prime Minister Antonis Samaras. For Syriza leader Alexis Tsipras it may be out of reach if he continues to reject austerity measures that would likely be part of an ECCL..."

American-born former prime minister wild card in messy election - Washington Post

"Former prime minister George Papandreou -- son of the political firebrand who negotiated Greece’s 1981 entry into what would become the European Union -- has no chance of coming out on top with his newly minted Movement of Democratic Socialists party.

In fact, it could count itself lucky, polls suggest, just to clear the 3 percent threshold to get some seats in parliament.

But even that would be enough to take on the role of wild card.

...If Syriza looks in Papandreou’s direction as one of the potential junior partners, it could bring a major sigh of relief from Brussels and beyond. Papandreou is seen as the type of figure beloved by the bureaucrats and bankers keeping Greece afloat: steady, predictable, non-confrontational."

January 13, 2015

Tsipras: Greece fighting 'fiscal waterboarding' - Yahoo News

"Alexis Tsipras wrote in a guest commentary in Germany's Handelsblatt business daily that recent claims the Greek economy was stabilising following austerity policies imposed by creditors were an "arbitrary distortion of the facts".

"The truth is that Greece's debts cannot be paid back as long as our economy is submitted to constant fiscal waterboarding," Tsipras, who heads the radical left-wing Syriza party, said.

His party wants to abandon the austerity policy imposed by the European Union and the International Monetary Fund as part of the country's 240-billion-euro ($282 billion) bailout."

Gikas Hardouvelis warns: could exit euro 'by accident' - Economic Times

"An accident could happen (in a stand-off with Europe), and the whole idea is to avoid it," Hardouvelis, an economist and technocrat -- who has drawn Syriza's ire by wading into the political debate -- told Bloomberg TV.

Hardouvelis on Tuesday noted that Greeks "cannot threaten the rest (of Europe) with our own exit". "This is not a bargaining chip on our side... Europe has built defenses against a country leaving the euro area," he told Bloomberg.

On Monday, the finance ministry had also warned that Syriza would face a rapid cash shortage should it win the election and then challenge the country's EU-IMF creditors..."

January 12, 2015

"Another Chapter 11 for Greece, the third in five years — and no exit in sight. The Greeks won’t do the eurozone the favor of absconding from the common currency. Never mind that they should never have been accepted in the first place, when they cooked the books to look prim and proper.

...This is the core of the crisis: a monetary game of chicken. As we know from war gaming, the party that appears to be crazier than the rest tends to score. Strategists call this the “rationality of irrationality.” Foam at the mouth, and you’ll get your way more easily than meekly asking for another 100 billion euros.

Crazy the game is not. The Greeks have been saved twice: in 2010, with 110 billion euros ($147 billion), and in 2012, with 130 billion euros ($173 billion). In 2011, private investors had to take a 50 percent write-down on their holdings of Greek government debt. These bailouts have created their own expectations in Greece.

...with its tiny economy, Greece can and will be saved, again. It is too small to fail, so to speak. "

January 11, 2015

Syriza Party Holds Polling Lead - WSJ

"Greece’s leftist opposition Syriza party continues to hold a narrow lead in a series of public-opinion polls published over the weekend, two weeks ahead of the country’s national elections.

In nine separate opinion polls that were published in the Greek media during the past two days, Syriza was poised to win the coming vote, edging out the ruling New Democracy party by a margin of between 2.7 and 5.5 percentage points, with most of the polls showing an average lead of about 3.2 percentage points—slightly above the margin of error.

...Greece’s coalition government—comprising New Democracy and its junior partner, the socialist Pasok party—has been forced to conduct snap elections this month after the Greek Parliament failed in late December to agree on a new head of state for the country.

Under Greece’s electoral rules, the winning party is automatically awarded 50 bonus seats in Greece’s 300-seat legislature, a measure aimed at facilitating the stability of an elected government..."

January 10, 2015

Syriza maintains lead ahead of snap poll - Reuters"The Greek leftist party Syriza's poll lead over the ruling conservatives was stable at 3.4 percentage points, a survey showed on Saturday, two weeks before an election."

Greece and Venezuela on Edge of Government Bond Default - Desrt Sun

"Greece and Venezuela have precious little in common location-wise, ethnic population makeup, or historical tradition, these two distinct entities share the unpleasant reality of financial default in 2015. In both cases, the problem derives from a fallacious econo-political governmental approach that has attempted to provide comprehensive social benefits that nationally generated revenues are unable to support.

Greece, whose tragic lack of economic viability since the end of World War II has been, in recent years, supported by membership in the European Community, primarily financed by its succession of governmental loans through the Eurozone's money-lending agencies. They'll be left holding the bag upon default.

With few natural resources or exportable goods to generate adequate revenues, Greece has lived well beyond its means in its difficult attempt to provide social services for its 11 million-strong populace that it can ill afford. This has been complicated by a left/right wing political confrontation that has brought this once glorious nation to the edge of bankruptcy...."

January 9, 2015

Greece's new Potami party prepares for kingmaker role - Reuters

"Journalist-turned-politician Stavros Theodorakis is shaping up as a possible kingmaker after Greece's general election.

In a campaign fought between the main forces in Greek politics, opponents and supporters of the country's international bailout, Theodorakis refuses to take sides and describes his centrist To Potami party as "post-bailout".

... Potami's support in a poll published this week was 4.5 percent, just ahead of a group of other smaller parties. While this is far behind the two main groups, it represents a remarkable placing for a 10-month-old movement.

"...We want Potami to be the force that will pull the biggest party in the right direction and ensure we have neither far-right policies nor anti-European policies," 51-year-old Theodorakis told Reuters in an interview. "

Greece’s next crisis - Boston Globe

"...Greece has made progress in repairing its economy. Stifling labor regulations have been relaxed, tax receipts are up, and Greece is running a primary government surplus. Greek debt service (now largely comprised of payments to public creditors) may be manageable given the subsidies that such creditors seem willing to provide, if growth returns. Business investment was starting to improve.

But reform has been slow and incomplete, and the government’s decision several months ago — backed by the troika, as the European Commission, the International Monetary Fund, and the European Central Bank are referred to locally — to declare the mission accomplished was a major error. It exaggerated the progress made and failed to recognize deep problems that remain. The government played into Tsipras’s hand by increasing public impatience with economic stagnation.

If Tsipras follows through on his promise to reverse existing reforms, then continuing troika aid is unlikely."

January 8, 2015

For Greece and Syriza, Financing Options Are Slim - Euro Insight"Assuming a Syriza-dominated government wins the coming Greek election, the financing options for Athens are looking increasingly binary: go for a big bang default or stick broadly with the current international support programs and the related conditionality, according to EU officials.

Syriza, which narrowly leads current opinion polls, has said that it intends to renegotiate the country’s official debt pile, call a conference of other indebted euro area countries, as well as take other measures like reversing privatisations and undoing austerity measures.

“....If Greece defaults then it needs to go all out, otherwise it will get no benefit and it would make no sense,” said a well-placed EU official, who spoke on condition of anonymity. “There’s not really a viable middle way.”

...Berlin’s position on Syriza has appeared to soften this week after the Der Spiegel magazine reported at the weekend that Chancellor Angela Merkel would be prepared to let the most-indebted country leave the bloc.

She has since distanced herself from that article saying in London on Wednesday that she backs keeping Greece in the euro."

National Bank of Greece (NBG) Stock Hits One-Year Low Today - The Street

"Shares of National Bank of Greece (NBG) fell more than 5% to a 52-week low of $1.50 in morning trading Thursday as shares sold off following a spike on Wednesday.

Newly released data on Wednesday showed Eurozone deflation materialized at the end of 2014. Consumer prices in the Eurozone declined 0.2% year-over-year in December, according to the first official estimate, CNBC said. This decline was worse than the 0.1% drop analysts had forecast, and marked a dip from the 0.3% increase in November.

More than 1.5 million shares had changed hands as of 10:16 a.m., compared to the daily average volume of 4,509,730."

January 7, 2015

Poll shows lead for Greece's Syriza narrowing slightly - Yahoo

"Greek anti-bailout opposition party Syriza's lead over the ruling conservatives has narrowed slightly, according to a poll conducted after Prime Minister Antonis Samaras called a snap parliamentary election for January 25.

That marked a slight drop from a 3.6 point lead Syriza held in the previous Alco survey. Syriza wants to scrap the painful austerity measures agreed by Greece under a 240 billion euro bailout program with its international creditors.

The telephone survey of 1,000 people, conducted on Jan. 4-6 nationwide, also showed that a party set up by former prime minister George Papandreou last week -- the Movement of Democratic Socialists -- would get 2.7 percent of the vote."

Greece ready to say goodbye to euro? - Pravda

"The veiled threat to the Greek Parliament was in a December memo from investment bank Goldman Sachs - the same bank that was earlier blamed for inducing the Greek crisis. Rolling Stone journalist Matt Taibbi wrote colorfully of it:

...Goldman's role in the Greek crisis goes back to 2001. The vampire squid, smelling money in Greece's debt problems, jabbed its blood funnel into Greek fiscal management, sucking out high fees to hide the extent of Greece's debt in complicated derivatives. The squid then hedged its bets by shorting Greek debt. Bearish bets on Greek debt launched by heavyweight hedge funds in late 2009 put selling pressure on the euro, forcing Greece into the bailout and austerity measures that have since destroyed its economy."

Why Europe is suddenly rediscovering Greece's financial instability - PRI

"...the majority of Greeks say they want to remain in the single currency. An exit from the Eurozone, dubbed a “Grexit” the last time around, and a return to the drachma might be catastrophic for the country in the short term.

And for the rest of the Eurozone, the new threat of a Greek departure (call it Grexit 2.0) raises a spectre that’s been hanging over the currency union for the past few years. Namely, first Greece goes, and then maybe Spain, perhaps even Italy.

Germany, the Euro’s powerhouse, has long said it supports doing whatever it takes to keep Greece in the currency union. But this week, Der Spiegel magazine quoted some high-ranking German government officials as saying that Germany could certainly survive a Greek exit, and might be willing to let them go if the Greeks really intend to renege on their fiscal commitments."

January 6, 2015

Bloodbath: Sensex tanks 855 pts on Greece woes, oil gloom - Financial Express

"The benchmark Sensex today plummeted by 855 points in its worst crash in five and a half years as stock markets globally went into a tailspin amid speculation about probable exit of Greece from the Euro region and oil prices cracking below USD 50 per barrel mark.

The Nifty also tanked 251 points, or 3 per cent. Both the bellwether indices closed at more-than two-week lows. Panic selling sent markets on a free fall with losses across sectors, traders said, adding that investor wealth plunged by nearly Rs 3 trillion as four counters fell for one that rose.

Oil prices continued to drop, with the US benchmark contract briefly falling below USD 50 a barrel for the first time in more than five years on concerns about ample global supplies and weakening economic growth."

Where did all the money go in Greece? - EU Corner

"The total amount of loans the eurozone and the International Monetary Fund supplied to Greece between May 2010 and the most recent disbursements last summer stand at 226.7 billion euros. This is equivalent to almost 125 percent of Greece’s economic activity in 2014. There seems to be a general misconception that feeds a misleading narrative in which the loans were used to keep the Greek state afloat, maintain its basic operations and pay salaries of doctors, teachers and policemen.

...Greece started the fiscal consolidation effort with a deficit before interest payments of circa 24 billion euros in 2009 and was running a primary deficit in 2010, 2011 and 2012. From 2013 onwards, though, revenues exceeded expenses and no financing was needed to cover state operations.

...Greece started repaying last year the IMF loans supplied during the Stand By Arrangement of the first programme. A total of 9.1 billion euros was paid back by the end of 2014. Greece also had to participate in the paid in capital of the European Stability Mechanism, to the tune of 2.3 billion euros

...The breakdown of how the programme funding was allocated clearly illustrates the crisis management strategy Greece’s lenders opted for. Eurozone leaders, with the reluctant agreement of the IMF, made a conscious decision to use almost two thirds of their “taxpayers’ money” (as they like to refer to it) to service the debt which they refused even to reprofile at the beginning of the crisis, when it was essential and could have given Greece a chance of recovery."

January 5, 2015

German bank exposure to Greece around 24 billion euros: - Yahoo Finance

More coverage:"The lion's share of German exposure is held by the state-owned development bank KfW, with lending totalling 15 billion euros to the Greek state, the banking industry group BdB said.

Commerzbank said it held around 400 million euros in exposure to Greece at the end of September, while Deutsche Bank said it held around 298 million euros in exposure to corporate, bank and public debt.

Greek politics has weighed on markets including the euro as speculation intensified that Greece could leave the euro zone after a snap election on Jan. 25.

A study by JP Morgan found that the French bank Credit Agricole (CAGR.PA) was the most exposed of Europe's commercial banks."

Bank exposure 18 billion pounds - Reuters

Greece again threatens to exit eurozone – and Europe shrugs - CS Monitor

"In 2012, the prospect of a "Grexit" – a Greek exit from the eurozone – had the entire global economy on edge.

Fast-forward two years: Greece is facing elections Jan. 25 after parliament failed to elect a new president last week. The far-left opposition Syriza is poised to take the lead – and its leader, Alexis Tsipras, says he'll change the terms of the country's bailout agreement and put an end to German-led austerity if it does. Greek Prime Minister Antonis Samaras, meanwhile, has warned that Greece's membership in the eurozone hangs in the balance.

This time, European leaders appear more blasé about an outcome they once feared. The reason: They feel the EU has undergone so much reform since 2012 that one country's exit might not cause a domino effect.

...the Der Spiegel report nevertheless reflects sentiments held by observers throughout the EU: namely, that it would manage even if Greece left, largely due to reforms that have been pushed through across the eurozone, from bodies in Brussels to national governments."

Gold Ends Above $1,200 Amid Worries Over Greece - Finanzna Chrichten

"Gold futures ended sharply higher on Monday, extending gains from the previous session, with investors seeking the safe haven of the precious metal on concerns over the Greek crisis and fears of a global economic slowdown following crude oil's extraordinary plunge to new depths.

The precious metal continued to benefit with the euro at a near nine-year low against the dollar, amid worries that Greece may be on the verge of an exit from the eurozone following the general elections on January 25.

...Gold for February delivery, the most actively traded contract, surged $17.80 or 1.5 percent to settle at $2,204.00 an ounce on the Comex division of the New York Mercantile Exchange on Monday."

January 4, 2015

Tsipras says ECB cannot shut Greece out of stimulus- Reuters"...opposition leader Alexis Tsipras said the European Central Bank (ECB) could not exclude Greece if it decides to move to a full "quantitative easing" program to stimulate the euro zone's faltering economy.

Speaking at a party congress on Saturday, three weeks before a Jan. 25 general election, Tsipras also said his Syriza party would ensure much of Greece's debt was written off as part of a renegotiation of its international bailout deal.

"Quantitative easing by the ECB with direct purchases of government bonds must include Greece," Tsipras said.

The comments underline the pressures facing Draghi ahead of the decision, with many in Germany opposed to full-scale QE which they fear will create asset bubbles and remove incentives for reform-shy governments to act."

Venizelos: PASOK is the guarantor of stability in the country - ethnos.gr

[This article in English from Google Translate ]"Mr. Venizelos stressed that the real value of the coming election is who will be the guarantor of stability.

PASOK guarantees certain national necessities, which are, first: political stability in Greece's turbulent political world; second: economic stability, which includes a position of staying in the euro; third: insisting the eurozone respect the sacrifices the people of Greece have made; four: PASOK's inherent institutional stability, which means a dependence upon the rule of law and not revanchism."

German government confident Greece will stick to reforms - Reuters

"....spokesman Georg Streiter declined to comment on a report in Der Spiegel magazine that said Merkel's chancellery had shifted its view and now believed the euro zone would be able to cope with a Greek exit if necessary.

"Greece has fulfilled its obligations in the past. The German government assumes it will continue to fulfill its contractual obligations to the troika," Streiter told Reuters.

"Every new government has to abide by the contractual obligations of the previous government."

The 'troika' overseeing Greece's 240 billion euro bailout comprises the European Central Bank, the European Commission and the International Monetary Fund."

A Weary Greece Considers Its Options - NY Times

"...leaders of Syriza have said they want to keep Greece in the euro currency zone. A departure from the monetary union would be highly destructive to the country’s weak economy. And while investors do not seem as worried about what a Greek exit from the euro might mean for other countries like Spain, Portugal and Italy as they were a few years ago, they do have some concerns.

This much is clear: More suffering will not stabilize Greece or allow it to pay off its debts. Its unemployment rate was 25.5 percent in the third quarter of 2014. That is only modestly lower than the average rate of 27.5 percent in 2013. Deflation is a reality; consumer prices fell 1.2 percent in November after a 1.8 percent drop in October. Although the economy is growing again — gross domestic product increased 0.7 percent in the third quarter from the previous quarter — most people are not seeing improvement in their lives.

There is no question that the austerity policies, like cutting spending and raising taxes, that the troika demanded in exchange for helping Greece and other troubled eurozone countries have prolonged and deepened their economic slump..."

Papandreou launches party, aims for post-election role - eKathimerini

"Papandreou said the his party would be called the Movement of Democratic Socialists. If the former PASOK leader’s new grouping is able to gain more than 3 percent in the polls in three weeks’ time, he might gain enough seats in Parliament to have a say in the formation of the next government. Crucially, the new party could also have an impact on how PASOK performs.

“Many people believe that the main issue at stake in these elections is whether they will be won by New Democracy or SYRIZA. Clearly, that is crucial but not as crucial as the issue of how the country will be governed,” Venizelos told Kathimerini, pointing out that if neither party has a parliamentary majority, a coalition will have to be formed."

January 3, 2015

Political contagion vs economic contagion - Economy Watch"What makes Greece's case different from other debtors that have often used attainment of a primary surplus to squeeze extra concessions from the creditors, or defaulted, is that its debt is primarily in official, not private hands. Of the roughly 320 bln euros of debt, only 54 bln is in private hands. The rest is owned by the EU collectively and individually, the IMF and ECB...

...parts of Syriza's platform are frankly more difficult for the official creditors to swallow. There can be no budget agreement annulment. Unwinding some of the austerity measures in terms of civil servant salaries and pensions will destroy the very conditions that allow Greece to negotiate, if not from a position of strength, then a stronger position nonetheless. There may be room for some additional government spending, but it will not be acceptable to return to the pre-2009 period.

...The risk lies in the opposite direction. If Syriza were to lead Greece out of monetary union, would not others be emboldened? There are parliamentary elections in five euro-zone countries this year (Greece, Estonia, Finland, Portugal and Spain). On New Year's Day, Italian President Napolitano indicated intentions to resign following Italy handing over the rotating EU presidency to Latvia...

Podemos in Spain has come from nowhere to lead the polls, and its agenda is very similar to Syriza in terms of unwinding austerity measures. Would Podemos be fearful of a Greece exit or would it be like a shot of adrenalin and encouragement. The risk of political contagion may very well prove to the channel of economic contagion."

EU washes its hands of Greece as it dissolves parliament - UPI

"... Syriza claims it will keep digging Greece out of its money problems while remaining in the Eurozone. At the same time, it vowed to renegotiate the bailout deal with the EU and the IMF in order to roll back some of the reforms required by its creditors. It also hopes to have the creditors to write off some of the debts that continue to cripple the country...

"Syriza's victory in elections will jumpstart a massive national effort to save society and restore Greece," said Syriza's leader Alexis Tsipras.

As required by the constitution, the parliament was dissolved ahead of the special election. Germany and the EU have warned this could spell the end of the rescue efforts from the EU.

"The times when we had to rescue Greece are over," said Michael Fuchs, a senior member of Chancellor Angela Merkel's party in Germany. "There is no longer any potential for blackmail. Greece does not have systemic meaning for the euro."

Deutsche Welle: Greece Could Fall Behind Again - Greek Reporter

“The Greeks know very well what a wrong election result would entail,” European Commission President Jean-Claude Juncker warned bluntly.

In its analysis, Goldman Sachs has been even more outspoken. “In the event of a [SYRIZA-led government no longer paying its debts, leading to a] severe Greek government clash with international lenders, interruption of liquidity provision to Greek banks by the ECB could potentially even lead to a Cyprus-style prolonged ‘bank holiday’,” it said.

How to save Greece now - eKathimerini

"The forthcoming election could rekindle the turmoil that's threatened to unravel the euro in recent years. European Commission President Jean-Claude Juncker's recently announced plan to invest 315 billion euros in infrastructure programs is a tacit acknowledgment that the EU needs to do more to boost growth. But that sentiment needs to be reflected in future negotiations with Greece's leaders, and indeed with other euro members whose electorates are growing dangerously weary of austerity.

The EU's apparatchiks will need to take seriously SYRIZA's demands for an easing of Greece's economic strictures -- or risk turning the political drama into an economic crisis. If Greece were to abandon the common currency project, it would call into question the membership credentials of other euro nations. (Note that Portuguese bonds are also taking fright today.)"

Decline in Real Estate pricing continued in 2014 - ethnos.gr

"...Especially in the center of Athens, the situation is dramatic, as 2014 showed cases of property offers considered unthinkable a few years ago. Houses from 3,000 euros, as that is done just one square meter in the northern suburbs, certainly shocking to thousands of owners gave a fortune a few years ago and now have lost their value.

Typical offers are: The Beehive, basement apartment of 20 sq.m. courtyard with an initial price of 3,000 euros, which is offered instead of 150 EUR / sq.m., 5th floor studio of 15 sq.m. in Ambelokipi, built 1977, for sale ... 10,000 euros. Studio 7th floor of 12 sq.m. in Attica Square sold 6,500 euros. Apartment of 30 sq.m. in the center of Thessaloniki sold just 7,500 euros. Basement 40 sq.m. again in Thessaloniki given 10,000 euros.

...Significant drop in prices of land, mainly in Attica. According to a recent poll of E-Real Estates, there are reductions of 75% compared to pre-crisis levels.

The biggest decline recorded in expensive areas such as Ekali where the 2009 square meter cost 4,300 euros... today the cost is no more than 1,550 euros per square meter."

[This article in English from Google Translate ]

January 2, 2015

Political Crisis Might Force Greece Out Of The Euro - Business Insider"...Athens is firmly back in Europe’s spotlight along with a serious discussion about whether Greece will remain in the euro.

That’s because Syriza, the radical leftist coalition that wants to tear up the country’s bailout rules, looks likely to win. That means a game of chicken with the EU institutions and International Monetary Fund. If either side refuses to back down, there could be market chaos, bank runs, and a forced exit from the euro.

...German politicians are lining up to issue stern warnings to Greece that it won’t allow any further easing or assistance for struggling countries on Europe’s periphery."

Greece: Former PM Papandreou to form new party -Houston Chronicle

"Former Greek prime minister George Papandreou has revealed plans to create a new political party — a development that will see him break away from the once powerful PanHellenic Socialist Movement founded by his father.

Papandreou, 62, announced the plan on his website Friday, ahead of a snap general election on Jan. 25."

El Pais: Bankruptcy, increasing unemployment, poverty doubled - ethnos.gr

"Then the article [El Pais] states that SYRIZA gets stronger in the polls, but far from an absolute majority, and described what would happen in the event of non-payment of debt while increasing public spending, as suggested SYRIZA.

"This will lead to bankruptcy of the banking system, would force the ECB to close access to financing and in 24 hours the Greece should leave the euro [...] .

[The situation] would cause the bankruptcy of the state, banks and all indebted families and businesses, increasing unemployment at 35% and doubling the rates of poverty and evictions..."

[This article in English from Google Translate ]

January 1, 2015

Election Campaign Starts With Clash Over Debt - ABC News"The campaign for Greece's general election next month is now underway, with the country's conservative prime minister claiming his anti-bailout opponents would "lead the country to default."

Antonis Samaras was responding to televised remarks by an official of the left-wing Syriza party that it would freeze interest payments on international bailout loans unless Greece was granted better terms on its 240 billion euro ($291 billion) rescue program.

Leading opinion polls, Syriza has promised to re-negotiate the bailout agreements, while insisting that it would avoid taking unilateral actions against leaders from other eurozone countries and the International Monetary Fund."

Samaras: "SYRIZA has plan to bankrupt the country" - ethnos.gr

[This article in English from Google Translate ]"... the decision not to pay interest and amortization. That is, to let the country default and go into bankruptcy. It is an official poverty program being presented to the Greek people in this election cycle. Let everyone see this reality. It's incredible! ".

SYRIZA called this charge "stale scaremongering." "The SYRIZA program is to negotiate for the country's interests in order to restart the economy and support the society and that is the purpose of stopping the payment of interest and loan amortization."

"This would mean the automatic declaration of our country into bankruptcy and its exit from the euro", said State Minister Dimitris Stamatis. "And they know it very well! That is where they want to go with Greece. This is their real plan. And admit it themselves."

Troubled EU hoping the only way is up in 2015 - Yahoo News

"An election that may bring to power leftists opposed to Greece's harsh bailout conditions could dampen the enthusiasm generated by a December EU summit that created a strategic investment fund to kick-start the EU's sluggish economies and generate job growth.

Instead of plotting a bright future, the EU could soon be plodding through one crisis after another again.

Yet in a sense, it has always been this way.

"Europe doesn't move in giant leaps. It moves forward, muddling through," said Hendrik Vos, the University of Ghent's EU expert.