NEWS ARCHIVE - MAY 2010

For current news items, go to the home page

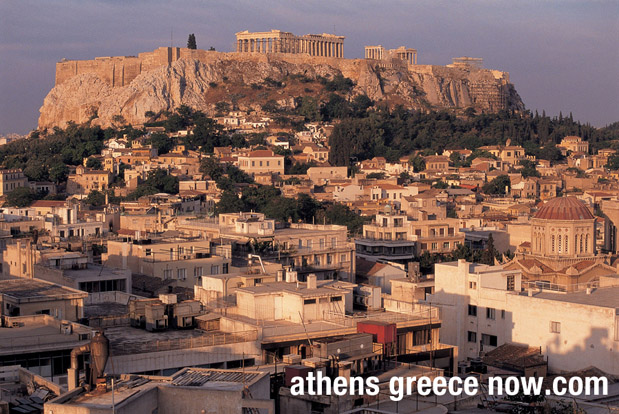

The Acropolis in Athens, Greece. Source: Big Stock Photo

May 18, 2010

Funds transferred to Athens; helps market slightly

Euro takes a beating amid scares over longevity

A brief MSN note on the effects of the transfer of bail out funds to Athens:

" The euro fell on Tuesday despite progress on a rescue package for debt-stricken Greece and U.S. stocks fell in choppy trade as the weakness of the euro stirred concerns about the impact on sales of technology companies with big overseas sales.

Investors' aversion to risk remained high, despite progress on a rescue package for Greece, driving up U.S. Treasury prices. Some analysts questioned the sustainability of the global economic recovery and the ability of the U.S. Federal Reserve to begin to move away from keeping short-term interest rates near zero percent.

European shares, however, rose, snapping two consecutive days of declines, after Greece received funds from the European Union to repay its immediate debt.”

Might Germany be the first one out the door in a eurozone collapse?

Like Paul McCartney quitting the Beatles suddenly after trying to keep the other three members in the famous european pop band, Germany is now hinting they may break free of the eurozone block before anyone else can make it to the door. All this from the market oracle online:

"Rumors of the imminent collapse of the eurozone continue to swirl despite the Europeans’ best efforts to hold the currency union together. Some accounts in the financial world have even suggested that Germany’s frustration with the crisis could cause Berlin to quit the eurozone — as soon as this past weekend, according to some — while at the most recent gathering of European leaders French President Nicolas Sarkozy apparently threatened to bolt the bloc if Berlin did not help Greece. Meanwhile, many in Germany — including Chancellor Angela Merkel herself at one point — have called for the creation of a mechanism by which Greece — or the eurozone’s other over-indebted, uncompetitive economies — could be kicked out of the eurozone in the future should they not mend their “irresponsible” spending habits.

Rumors, hints, threats, suggestions and information “from well-placed sources” all seem to point to the hot topic in Europe at the moment, namely, the reconstitution of the eurozone whether by a German exit or a Greek expulsion. We turn to this topic with the question of whether such an option even exists."

Biggest reform effort in 60 years for Greek government?

Kathimerini commentary declares that the stakes are too high and the efforts too small thus far by Papandreou in trying to stave off disaster:

"In the coming months the socialist government must implement what is undoubtedly the most ambitious and most difficult reform program of the past six decades.

...it remains unclear whether George Papandreou’s administration grasps the true magnitude of the enormous challenge that lies before it."

A positive picture for Greece's future

In the avalanche of doom from the world press, this article in the Financial Times by Michael Skapinker contains both the facts as we know them, and an easy proposition for Greek success if repetition of obvious past habits in government can be stopped:

"Greeks do not lack talent or initiative. You only have to look at how many succeed abroad, once they escape their country’s dysfunctional, influence-peddling institutions. The desperate need to reform those institutions has finally been laid bare. There can be no more illusions, for Greece or its friends."

I first saw Skapinker's article at the living in greece blog.

Go ahead and default! Says CNN Money

This article at CNN Money Fortune by Dody Tsiantar says the obvious: Just get it over with, Greece:

"...key concern: the measures Greece has been forced to impose are so severe and wildly unpopular that observers fret the government won't have the political will to see them through. Economists also worry that the very medicine prescribed by the IMF and Greece's Euro-partners -deep budget cuts, sharp wage reductions and tax increases- will push the economy into a recessionary spiral that will spin downward faster than Sisyphus' lost boulder.

... If the loan conditions will bring in as much agony as is predicted, why not walk away from their obligations - the same way so many thousands of debt-saddled Americans have-instead of taking on even more debt to pay them off?

Of course, it's not that simple. Americans who don't pay up end up with bad credit. And when a company goes bankrupt, it risks having to shut down forever. But what happens when a country defaults? Obviously, Greece won't melt away into the Aegean Sea. The Parthenon won't vanish.

"A company can go bankrupt. Individuals go bankrupt. But sovereigns don't," explains Jan Randolph, head of the sovereign risk group at IHS Global Insight. "They stop paying and don't service their debt obligations like they're supposed to. But people still grow carrots, people go to school, traffic lights work."

That doesn't sound so bad, but don't be fooled. A 2008 IMF working paper, titled "The Costs of Sovereign Default," found that post-default, most economies, on average, tend to shrink by 1.2 percentage points a year during restructuring. Often, more severe political, social and financial consequences follow.

Take Argentina, which defaulted in December 2001 after struggling with IMF-imposed austerity measures for several years. Unemployment hit 20%, GDP declined by 15% and nearly half its population ended up living below the poverty line."

Echoes from the past

An editorial commentary at Neo Kosmos by Vrasidas Karalis which states some of the obvious jibes at recent Greek governments, but also shows how current events are reminiscent of earlier crisis in modern Greece history:

"In 1893, Greek prime minister Charilaos Trikoupes, made one of the most dramatic declarations in Greek history: "Unfortunately, we are bankrupt!" What had happened?

An extensive program of reforms and infrastructural modernisation, through railways and grand public buildings, didn't give back the expected revenues.

The financial administration of the state was taken over by the International Financial Control, as it was called then, and extra levies on all transactions were imposed, in order for the debts to be paid back-debts which were taken to repay previous debts or even simply the interests of previous debts.

The government was forced by the International Control to withdraw from circulation a considerable amount of money, to minimise corruption and reduce public spending-and they were successful!

Furthermore it proceeded with a number of social reforms that by 1910 made the Greek economy one of the strongest in Europe,

...The reality is that beyond the structural problems of Greek economy the main reason for the financial crisis lies with a political establishment that has ruled the country for the last 30 years.

All governments proved to be unfit to govern; their authority was based on the fact that there were no control mechanisms in the political financial system while all of them were sure that they stood above the common criminal law. No minister has ever been prosecuted for corruption in Greece while billions of Euros are missing from public coffers! "

May 17, 2010

Bailout only "buying time"

Euro takes a beating amid scares over longevity

A brief Bloomberg article by Ben Levisohn on the uncertain fortunes of the shared eurozone currency:

" The euro fell to its lowest level since the collapse of Lehman Brothers Holdings Inc. on concern that the 16-nation currency may be headed for disintegration.

The shared currency fell for a fourth week versus the dollar and a third week versus the yen, the longest losing streaks since February, as German Chancellor Angela Merkel said that Europe is in a “very, very serious situation” despite a rescue package for the region’s most indebted nations. European Central Bank Governing Council member Axel Weber speaks on financial-market regulation next week in Berlin.

“We went through a massive liquidation trade in Europe and risk-taking positions were wiped out across the board,” said Sebastien Galy, a currency strategist at BN Paribas SA in New York. “The markets are trying to figure out what the consequences are for growth. There are massive uncertainties and that will keep the downward pressure on the euro.”

The euro fell 3.1 percent to $1.2358 this week, from $1.2755 on May 7. "

Business Insider in 2013: Greek unemployment at 20%

Though meant to be funny, this brief piece at business insider about how the Greek bailout finally breaks europe in two contains fairly horrifying consequences: 20% Greek unemployment, worthless investments and massive business insolvency:

"In 2010, GDP shrank by more than 5 percent (the government had predicted 4.5 percent decrease), in the following year by another 5 percent (instead of the predicted decline to "only" 2.5 percent)."The Greeks are coming from a recession into a depression," some economists had said earlier. They warned: "The medicine can be worse than the disease." Thus the Greek patient was killed.As early as 2010 50.000 small and medium-sized companies were insolvent. And the bloated civil service jobs quarried masses, the unemployment rate doubled to 20 percent. "

May 16, 2010

Greece in denial? Is Athens a "Cauldron"?

A survey of new articles paint varied images of the Greeks as the ongoing crisis has become a fixture of the news cycles of news-gathering organizations. A Washington Post travel item (see below) says Athens is a "cauldron" and they don't mean the summer heat. George Will and Paul Sheehan both find blame in the societies themselves. and the Sheehan opinion piece from Australia seems nearly racist in the intensity of its attack.Papandreou: U.S. Banks have victimized Greece

A brief Wall Street Journal article by Nick Skrekas on the cycle of blame for the greek debt crisis:

"The Greek Prime Minister George Papandreou said Sunday that he agrees that U.S. investments banks victimized Greece and wants more regulation of financial markets, but that deficit reduction plans are progressing well.

Asked whether Greece was a victim of American investment banks in an interview on CNN on the Fareed Zakaria GPS show, Papandreou said there were "negative practices that are currently being investigated...so there is responsibility there."

The prime minister didn't rule out taking legal recourse against the banks, but he wants to review the results of investigations before making a firm decision.

Papandreou said: "In 2008 we had governments bailing out the financial markets and the banks, and now the banks are funding hedge funds that are betting against the same governments that actually helped them. "

Investment and business growth in Greece: Papandreou is in denial

Kathimerini editorial on the situation inside Papandreou's government in the crucial area of business growth:

"So far, at least, the government seems to be in some sort of denial – and it has refused to take the issue of growth and development as seriously as it should.

There can be no other explanation for the fact that there are certain people of questionable skill, experience or even credibility assigned to key posts whose purpose it is to attract investment. Meanwhile, we have also failed to see any significant initiatives taken on the front toward boosting investment and entrepreneurship.

The worst part is that it seems a war has broken out within the ranks of Prime Minister George Papandreou’s government over whose task it is to oversee large investment projects. This has created even more skepticism and confusion among potential investors, who are already wary about putting their money into Greece."

Additional coverage of this from Reuters "Greece says to probe U.S. banks role in debt crisis" and from Businessweek:

"In the CNN interview, Papandreou said many in the international community have engaged in “Greek bashing” and find it easy “to scapegoat Greece.”

He said Greeks “are a hard-working people. We are a proud people.” “We have made our mistakes,” Papandreou said. “We are living up to this responsibility. But at the same time, give us a chance. We’ll show you.”

CBS article "European Central Bank Economist: $1 Trillion Rescue Only Buys Eurozone Time, Not A Solution" paints a not very cheerful portrait of the future for high-debt EU countries:

" The 750 billion euro ($1 trillion) rescue loan package only bought eurozone countries more time, it didn't resolve the continent's underlying debt problem, the European Central Bank's chief economist says.

The market turmoil will only calm down if the 16 eurozone member states reform their economies and reduce their deficits, Juergen Stark told the Frankfurter Allgemeine Sonntagszeitung newspaper on Sunday.

"We bought time, not more than that," he was quoted as saying, adding the euro was not in danger "but in a critical situation."

Stark urged European Union leaders to use the limited time to introduce new rules to increase stability and growth, stressing the need for new automatic sanctions for countries that don't abide by the EU's debt rules."

Blame Department: George Will at Washington Post dumps on Greece (and the EU)

Washington Post op-ed from George Will which more or less says the EU naturally promulgates the debt-crisis behavior of nations:

" The dishonesty and indiscipline of a nation with 2.6 percent of the eurozone's economic product have moved nations with the other 97.4 percent -- and the United States and the International Monetary Fund -- to say, essentially: The consequences of such vices cannot be quarantined, so we are all hostages to one another and hence no nation will be allowed to sink beneath the weight of its recklessness.

Recklessness will proliferate.

"The coining of money," said William Blackstone more than two centuries ago, "is in all states the act of the sovereign power."

But the European Union is neither a state nor sovereign enough to enforce its rules: No euro-zone nation is complying with the E.U. requirement that deficits not exceed 3 percent of gross domestic product."

Blame Department: "Decadence" of the Greeks to blame: Australia SMH

Sydney Morning Herald opinion piece "Greece laid low by its decadence " by Paul Sheehan heaps all the problems of the present on the Greeks themselves en masse:

"This is the depravity of modern Greece, where political street intimidation is routine and public debt is larger than the nation's gross national product. This debt has been used to pay the bribes demanded by the militants, to pay for a giant public sector that Greece cannot afford, and whose workers expect a generous pension from the age of 58. Finally, this collective madness reached crisis point. Many people have blood on their hands in today's Greece. Violent demonstrations are commonplace. Deceit is endemic. Tax avoidance is the national sport. The public sector is bloated and strike-ridden. The government is bankrupt. The nation is deluded. The Greeks lied to get into the European currency union, then spent like fools once they gained admission."

Yikes: Is Athens a "Cauldron"?

Washington Post travel writers Andrea Sachs and Nancy Trejos on the situation in Greece:

" Anti-government protests have made this country a security risk, especially in Athens and other larger urban areas. Martin Kleiber, iJet's regional manager for Europe, calls the situation an "abstract threat hovering over the cities" and describes Athens as "a cauldron." Trouble is also brewing in port towns, due to a pending rule allowing international cruise ships to tie up at Greek docks. The law, which could affect the domestic cruise industry, is sparking protests.

Political figures, not tourists, are the main targets, but foreigners could become "incidental victims," says Kleiber. And although the strife may recede over the summer, Kleiber advises travelers to weigh the risks of visiting the flashpoint areas -- or head for the islands, which are peaceful for now. "

This kind of coverage on Greece is bad news indeed: nearly 20% of the Greek economy depends on tourism and the services necessary for foreign visitors to enjoy the Greek Mediterranean sun and water. travel writers advising that 'you're not going to be safe' on the mainland is threatening, to say the least, especially in a world economy that's been on the skids and there are even fewer travel dollars (rubles, yen, etc) than before. Union strikers blocking boats of tourists at Pireas is apparently something that's been noted by the travel press.

International Coverage on Greece

Watching the relatively small Greek communist party (KKE) get so much attention, especially visually for their colorful red flags and the huge banner they hung from the picturesque Acropolis, reminds me of how much news journalism becomes theatre once the tropes and cliche images are fixed. Is it just laziness or group--think in journalism that produces this cookie-cutter coverage? Or is the dilemma in Greece too complex and so it can only be served up through the ideological prism's of left-and-right political thought? Is the ignorance of one culture trying to report on a different one simply too tough?

With the very real chasm of debt opening up below the feet of the Greeks, the idea of the EU, at least one with Greece as a member, becomes problematic. In Washington DC, President Obama (and the presidents before him) can just call the U. S. Treasury and say "print more money." The Greek Prime Minister cannot do that. Instead, Papandreou is under the commands of the 'club rules' of the eurozone, and those rules are meant to not only restrain a country (like Greece) from creating debt out of proportion to the 'gross national product,' but it also is a mechanism in which the central banks of the EU can profit, which in effect benefits all of the EU with more capital wealth for even more productivity.

But it isn't playing out that way. Independent bankers and investors are watching the buildup of debt in the EU and are expecting a spectacular collapse. Greece came into the system late and is being forced to cash in its chips (what chips?) earlier than everyone else. The "news template" created to cover Greece right now may end up being a template for much of Europe. And then the hollow promises of previously discarded political systems will be beckoning with easy solutions. How Greece goes may predict how many other countries will follow.

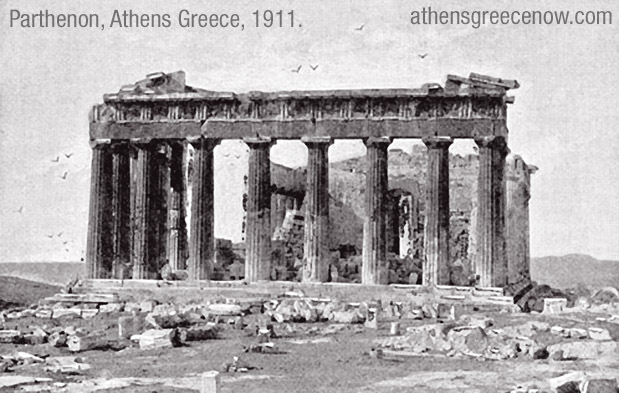

1911 photograph of the Parthenon in Athens Greece.

May 13, 2010

Greek unemployment climbs to 12.1% - WSJ

Unemployment rises 1.2% in one month

A Wall Street Journal survey of the troubles boosting jobless claims in Greece. Article by By Nick Skrekas:

"Greek unemployment rose to 12.1% in February from 11.3% in January, data showed Thursday, while economists warned that it will continue rising as new austerity measures start to bite.

In February 2009 unemployment had stood at 9.1%. "The momentum revealed in this reading is troubling and while we have forecast an average unemployment rate for the year of 11.7%, we are likely to now revise it higher to above 12%," said Nick Magginas, senior economist at the National Bank of Greece.

In a report issued on May 5, the International Monetary Fund said it expects unemployment to climb to 14.6% this year, before peaking at 14.8% in 2012. The European Commission, the European Union's executive arm. has predicted that Greek unemployment will rise to 11.8% this year from 9.5% in 2009, with a further rise in 2011 to 13.2%.

"The unemployment rate is on a rising trend due to austerity measures that will hit the domestic economy more severely in coming months," said Platon Monokroussos, head of financial market research at Eurobank. The measures will likely lead to a sharp decline in demand, large spare-capacity levels and an increasingly worrying economic outlook.

The statistics office said unemployment remains a more serious problem for women, with a jobless rate of 15.3% in February. Youth unemployment also remains persistently high across Greece with 32% of 15-to-24-year-olds out of work.

Is Greece 'calming down?' - New York Times

A New York Times article from Joanna Kakissis is full of anecdotes from Athens describing a sense of inevitability in Greece about the rough road ahead:

"Helen Skiada, a sales manager at a mobile phone company, was dejected by the smaller than expected turnout. But she said that Greece’s problems were so great, that people were losing the will to fight. She makes about €1,100 a month, or $1,400, and said she barely makes ends meet. She fears the crumbling economy will mean job cuts, including hers.

“We have nothing to look forward to, but we also have no choice but to come out here and fight,” she said. “I’m going to keep coming out to things, even if I’m the only one here.”

Another protester, Konstantinos Iliopoulos, who trains security guards, said that Greeks feel that a recession is inevitable and that more austerity measures lie ahead. “There’s a sense that nothing can be done, that the government will kill us with a thousand spending cuts,” he said "

Can the IMF force Greece to "shape up"?

A Buseinessweek article by Sandrine Rastello, Maria Petrakis and Jonathan Stearns announces at the Bloomberg Business Week site suggest that only the IMF has the willpower and experience to keep the pressure on Greece to in act all of the necessary reforms, at least as listed in the IMF/eurozone deal that is to be the Greek safety net for the next three years:

"Three institutions—the International Monetary Fund, the European Commission, and the Greek government—must prove the markets wrong and, in the process, restore the reputation of the euro. "If not mission impossible, it's certainly mission highly improbable," says Morris Goldstein, a senior fellow at the Peterson Institute for International Economics in Washington and a former IMF deputy research director.

Fixing Greece will be a complex exercise. The aim is to cut Greece's budget deficit to below 3 percent of its gross domestic product by the end of 2014, from 13.6 percent last year. IMF officials, including First Deputy Managing Director John Lipsky, have conceded that the cuts, such as freezing pensions and cutting civil servants' pay, will be "painful." IMF Director Dominique Strauss-Kahn warned that success hinges on Greek support "beyond political party lines."

...The question is whether the EC will hold the Greeks' feet to the fire. It is working with the IMF, which is providing $38 billion of the total aid package. Since the EC is senior partner, the IMF must play an unfamiliar supporting role.

The IMF has bailed out nations from Turkey to Korea and has far more experience playing the heavy than the EC. It suspended payments to Romania in November after political infighting toppled the government, and only paid up when a new government passed an austerity budget. The IMF in March 2009 froze a $256 million payout to Latvia after the country failed to commit to budget cuts. "

Elsewhere in Ta Nea it said that over 60 "night spots" in Athens and Thessalonica had been padlocked for tax evasion by the Ministry of Finance.

A ChristianScienceMonitor article by Allan Hall summarizes the discontent of the Germans who are financing the Greek's chance to survive the economic crash and remain eurozone and EU members.

"...those of us who understand Austrian economics and believe in free markets and sound currencies can see one more nail driven into the coffin of paper fiat currencies such as the euro, US dollar, British pound, and Japanese yen.

...The majority of the PIIGS's debt (Portugal, Ireland, Italy, Greece, and Spain) is held by large French and German banks. An outright default would've called into question the solvency of these banks for the second time in two years. In addition to being a bailout for the banks, it offers some respite to the PIIGS governments that were either experiencing or in danger of experiencing civil unrest. And it gives the short-sighted and jittery stock markets a breather. These are the most readily obvious reasons for the bailout.

...Inflation to bail out inefficient or overpriced users of resources, such as government and labor unions, diverts the pool of real savings from wealth creators to these entities. Unlike money and bank credit, which stays in circulation (mistakenly thought to be productive as per the Keynesian multiplier theory), real savings can only be consumed once. Bailout recipients outbid wealth creators for the real-savings pool, thwarting their attempts to maintain or expand production levels."

Night view of the Parthenon on the Acropolis, Athens Greece.

May 12, 2010

Greek tax evasion being attacked

Greek Inland Revenue launches search for "hidden jobs"

A Ta Nea article announces the Inland Revenue office is searching for Greeks who have secret second (and third) jobs which they have not been declaring income for. This will probably effect a number of public civil service employees, where the practice of "secret" jobs is rife, as termination of employment in a government position is nearly impossible.

"[paraphrase from translation of the Greek] Greek taxpayers who have falsified income by not declaring accurately monies from additional wages are being sought by the General Secretariat of Information."

Elsewhere in Ta Nea it said that over 60 "night spots" in Athens and Thessalonica had been padlocked for tax evasion by the Ministry of Finance.

Germans rebelling against Merkel's committing Germany to save euro

A UK Daily Mail article by Allan Hall summarizes the discontent of the Germans who are financing the Greek's chance to survive the economic crash and remain eurozone and EU members.

"Unless measures are taken to deal with the underlying structural problems affecting the most indebted of eurozone nations, then the bailout package merely kicks the can down the road,' said Michael Hewson, analyst at CMC Markets.

In Germany, the uncertainties were having a far more immediate effect.

...Voters already delivered their verdict on Mrs Merkel's handling of the Greece crisis by punishing her in a regional election on Sunday which saw her party kicked out of power in North Rhine-Westphalia.

...Many observers see the measure as delaying the end of the Euro, not preventing it.

Kai Carstensen, an expert at the Munich-based Ifo Institute for Economic Research, said: 'I fear that states will no longer feel any pressure to lower their deficits.

'Should they not massively reduce their debts, the problems will only be bigger three years down the road because the stronger countries are currently guaranteeing the debts of the weaker ones."

Dick Morris: Bailout will fail, then EU to buy up Greek (and Portugal, etc) debt

Article at The Hill.com paints a bleak future for debt management in the EU. Half-measures will fail and then to save the whole enterprise, the EU will have to assume all of the piles of debt made by the under-performing member states. Will Germany and France want to keep the EU and eurozone together badly enough to go to that extreme?

"When the European Union voted to put up a $1 trillion fund to bail out indebted countries in the Eurozone, it implicitly rejected the alternative, which was to purchase the Greek debt outright, making it an obligation of the EU as a whole and no longer just a Greek affair. By opting for the bailout, the EU has taken a middle course — one that won’t work — between full debt assumption and abandonment. The markets will keep pressing until the EU throws in the towel and buys up all the outstanding Greek debt. Shortly thereafter, it will have to do the same thing for Portugal and perhaps for Italy and Spain.

Greece owes $400 billion. Portugal owes $175 billion. And over the horizon lies Italy, which owes $2 trillion, and Spain, which is on the hook for $819 billion. Against these numbers, a $1 trillion fund doesn't inspire a whole lot of confidence.

...The next steps are obvious. The worry will spread to medium-sized countries like Italy and Britain and then to the biggest of all: the United States."

Kathimerini: Crisis is a rebirth for Greece, or the beginning of a far larger disaster to come

A gloomy Kathimerini editorial on the stakes for Greece:

"The most frightening thing about this terrible time is that no one knows whether this is the end of a bankrupt political, economic and social system and the start of a long and painful national rebirth, or whether the situation is unredeemable and we are condemned to an irreversible death as a nation state. Was the death of three bank employees in a firebomb attack during Wednesday’s general strike the senseless crime that will finally prompt widespread public revulsion at long-lived terror cults or will it go down in history as just one battle in a war that will tear the country apart? Greece is truly at a crossroads, a point of no return, which is more important even than the financial crisis.

...Reality today is a tug of war between two seemingly irreconcilable forces – the Greek electorate, on the one hand, and the demands made by our foreign friends in return for giving us enough money to keep digging ourselves deeper into debt, postponing our day of reckoning or giving us enough time to turn ourselves around.

...Our choice now is whether we will work as fast as possible to reform our state and make it productive, or whether we will stick to the roles that brought us to this sorry point, secure in the knowledge that things will only get worse."

Greek Gas: I saw it noted yesterday (May 11, 2010) that a gallon of gasoline in Athens was $7.35 per gallon.

May 11, 2010

IMF: Greece to suffer deep recession and high unemployment

Chance of 'rescue plan' failing is "undeniably high"

A Washington Post article by Howard Schneider surveys the released report from the IMF which sees the Greek future as dark and troubled:

"An internal International Monetary Fund assessment paints a gloomy picture of Greece's ability to recover economically, with years of high unemployment, slow growth and political bickering threatening to undermine a recently approved international rescue program.

...The risk that the joint IMF-European Union rescue plan will come unwound is "undeniably high," said the IMF staff note, which detailed the way in which even slight variations in the fund's assumptions about growth, inflation, interest rates, restructuring and other variables could leave Greece's debt load climbing despite the extraordinary international effort to help bring it down.

...After years of growth fueled by low-interest borrowing available after Greece adopted the euro, the country must now go through years of "internal devaluation" -- meaning falling wages and living standards, and a drop in economic output. Unemployment, the IMF projected, will rise sharply -- from around 10 percent this year to near 15 percent in 2011, where it is expected to remain for several years. "

Does the 'rescue plan' save both Greece and the Euro?

An aljazeera blog by Barnaby Phillips reporting from Athens speculates that the summer will cool off some of the street anger in Athens, but it's going to all come to a head again in August, when recession and the austerity measures start to pinch the Greek citizen between them:

"The enormous EU rescue plan, of almost 750 billion euros, (about $1 trillion, for those who can think that big) certainly impressed the markets, which soared, whilst borrowing costs for Europe's most vulnerable economies fell dramatically.

...Of course, what European leaders hope is that the mere existence of the "vehicle" will help restore confidence, and effectively buy Europe's economies more time to bring deficits under control, and make difficult policy changes, away from the focus of volatile markets.

...How long are German voters willing to pay for Greece? If the weekend's election result from North Rhine-Westphalia is anything to go by, perhaps not indefinitely. For that matter, how long are the people of Greece able to put up with a severe austerity package? Remember, Greece is trapped within the eurozone, so it cannot devalue its currency to help make its economy more productive.

...For what it's worth, my feeling is that the streets of Athens will begin to calm down as we approach summer. July and August - which are often extremely hot, and when many people go away on holiday- are not traditional times of protest in the Greek capital. Autumn, on the other hand, is another matter. The austerity measures will be beginning to bite, and the country will still be deep in recession."

Greece needs money immediately to extend loans

A Washington Examiner article by Aoife White and Verena Schmitt-Roschmann ponders how much the Greek future now depends upon a German willingness to hang on to the EU structure:

"The Greek debt tragedy has become Germany's burden because Berlin will provide the largest chunk of the eurozone rescue package available to all countries if they need it — at least euro123 billion — and a separate bailout for Greece agreed earlier which did little to halt the crisis. Germany's share of that is euro22.3 billion.

...Greece will Tuesday request a euro14.5 billion ($18.81 billion) loan from a European Union-led bailout fund totaling euro110 billion agreed last week, officials in Athens said. It will also receive a euro5.5 billion ($7.13 billion) loan from the International Monetary Fund on Wednesday.

Athens needs the money by May 19 to extend some euro9 billion ($11.67 billion) in debt, part of a soaring debt mountain that has worried financial markets and triggered a slide in the value of the euro and higher borrowing costs for Greece and other vulnerable eurozone nations.

French Finance Minister Christine Lagarde defended the currency as "solid" on Tuesday, saying European leaders had finally decided to turn vague political promises into a firm financial pledge after seeing that institutional investors — such as pension funds — were losing confidence in the euro last week.

Investors are still concerned that Germany may not approve the final package."

Greek government "on borrowed time"

It seems like the IMF/eurozone deal has put a gun to Greece's head in that there are stiff requirements for reform if the money is going to travel down to Athens. But that doesn't mean the Greek political leaders are going to go along, in fact some are simply boycotting the intra-government talks on how to work out the reforms that need to be implemented quickly in order to meet the requirments of the bailout. This Kathimerini editorial surveys the problem:

"The spirit of cooperation evident in Brussels in the early hours of yesterday morning, when European Union finance ministers agreed on a 750-million-euro support mechanism to ensure the Greek economic crisis does not spread, was absent from a meeting of party leaders in Athens, who failed to agree on the details of how Greece should tackle its problems.

...President Karolos Papoulias, who chaired the talks, made it clear that Greece's political system is existing on borrowed time. 'This is not the time for arguing, it is time for effective policies and dynamic intervention,' said Papoulias, who encouraged the leaders to agree on tougher sanctions for politicians, including removing their immunity from prosecution and greater transparency in politics by publishing parties' accounts and reducing their public funding."

May 10, 2010

Live cam shot of Athens from the south, looking northeast, from http://www.pireas.gr/

One Trillion Dollar Aid Package

$956 billion in USD / €750 billion euro Greek rescue plan

A 3 year plan meant to not only calm Greece but Europe and beyond has been unrolled from the Eurozone leadership. Some people are calling it the world's largest lottery win for the Greeks, as all of the tension in the world markets is forcing Europe to put a stop to half-measures to prevent a complete collapse of the system put together in the last decades that has been so lucrative for European investors and banks, and instead to throw everything at the problem at once.

Stephen Fidler and Charles Forelle at the Wall Street Journal describes the package as a race against disaster:

"The European Union agreed on an audacious €750 billion bailout plan in an effort to stanch a burgeoning sovereign debt crisis that began in Greece but now threatens the stability of financial markets world-wide..."

"...The money would be available to rescue euro-zone economies that get into financial troubles, the diplomats said. The plan would consist of €440 billion of loans from euro-zone governments, €60 billion from an EU emergency fund, and €250 billion from the International Monetary Fund."

"The giant bailout package reflects the gravity of the crisis gripping Europe and growing fears that the situation may grow so dire as to hamper the fragile rebound in the global economy. It would also cast aside long-held notions that each EU nation should manage its own finances, opening an era in which members of the common currency take on unprecedented responsibilities for each others' fiscal troubles."

Times of India describes the package:

"Eurozone leaders have agreed on a bailout package of nearly $1 trillion (750 billion euro) for Greece, as part of their concentrated efforts to prevent the debt crisis contagion from spreading to other nations.

In a marathon 11-hour-long session that lasted till early morning today, finance ministers from the 16 Eurozone countries, along with International Monetary Fund (IMF) officials, agreed on a three-year aid plan for Greece.

Under the plan, the European Union Commission will make available 60 billion euros ($75 billion), while countries from the 16-nation Eurozone would provide bilateral backing through 440 billion euros ($570 billion).

The IMF would contribute an additional sum of at least half of the EU's total contribution, or 250 billion euros ($325 billion).

...The package announcement also fuelled Asian oil prices, which rebounded to $77 a barrel after last week's decline.

Last week, stock markets across the globe had slumped as rising concerns over the worsening European debt turmoil sparked a massive sell-off by investors.

Earlier, global rating agency Moody's had warned that the Greece debt crisis could impact banking systems in many European countries, including Spain, Portugal and the UK. "

"Canary in the Coal mine" meme getting more steam. This post at USA National Review by James C. Capretta describes the Greek economy as a warning sign for a number of other economies, if not the EU and world in general. Capretta predicts a grim future all around:

" But even if matters do work out well over the coming weeks and months, what’s happening in Greece is almost certainly an early sign that Europe’s long-in-coming day of reckoning is now at hand.

Yes, Greece is an outlier. Its debt is higher than elsewhere in the eurozone. More taxes seem to go uncollected there than just about anyplace else. And the state apparatus looks to be almost beyond belief in terms of its size and drag on the economy.

But the most debilitating disease afflicting Greece is also present in every other western European country. They all have more and more people living off of an expansive social welfare structure, even as their workforce is aging, shrinking, and losing ground to global competitors."

This brief item at the Associated Press by Demetris Nellas about the recurring pre sense of stray dogs at the Athens demonstrations:

"They roam the streets of Athens unperturbed, a blue collar around their necks indicating that they have been neutered by the city authorities.

Athens' stray dogs naturally seek company. And there's no better place to find lots of it than at one of Athens' many demonstrations.

Photographers have documented the presence of several yellowish dogs at boisterous anti-government protests over the years, barking and baring their teeth at police in what appears to be canine political statements. One, Kanellos (cinnamon in Greek, from its color) used the Athens Polytechnic school as its base and was a constant companion for over a decade to anarchist rioters until he died, in July 2008.

He has his own Facebook page, with nearly 1,900 fans and a song dedicated to him. "

For more about the (mostly) innocuous dog packs of Greece, there's a good description of the dilemma at Matt Barret's Athens Guide:

May 8, 2010

Class war in Athens? Is the civil war of the late 1940s about to revisit itself upon Greece? Article at the UK Telegraph by Harry de Quetteville:.

"some amid the crowds venting fury about the terms of the bailout were anarchists who sought to sow chaos and violent disruption for its own sake. The majority were not. Many in the huge crowds were those who felt that they had been cheated by the rich. The air was thick with a sense of injustice. And as three charred bodies were pulled from a bank that had been torched, the spectre of something altogether more sinister than just the usual run of riots hovered over Greece – class war."

Is everyone in Greece to blame for this turn of events? Article at the UK Guardian by Helena Smith suggests that the system of corruption is so acute that 30% of the actual Greek economy is undergound evading the' taxman', and that the 'taxman' himself is so corrupt that of course he is evaded:

"The abundance of perks, benefits and bonuses that pushed profligacy to its limits was nurtured by runaway bureaucracy that gave way to loopholes and abuse. It was a system in which phony invoices and receipts thrived next to phantom committees and working groups that never met. The environment ministry, alone, was discovered to have 31 such organisations, including a committee for a lake that had ceased to exist back in the 1930s when it dried up.When Papaconstantinou took over the finance ministry he found staff telephone bills that ran into the thousands, monthly newspaper bills of 25,000 euro and ministers claiming 18,000 euro curtain bills for their offices."

Fears of Greek "Contagion" hits US Stocks. Reuters article by Angela Moon rounds up the stock market fears:

"U.S. stocks turned negative for the year on Friday on fears of another credit crisis stemming from Greece's souring finances and lingering questions about what triggered the previous session's dramatic plunge."

"...Governments around the world tried to calm markets after fears about Greece's debt crisis spread further. The cost of protecting European bank debt against default reached levels not seen since the height of 2009's economic crisis."

How did Greece do this to the world? Washington Post Blog article by Ezra Klein involves a question and answer with Desmond Lachman from the American Enterprise Institute:

"What has happened to Greece? We've gone from rarely hearing about them, to occasionally hearing about them, to being told the global financial system is threatened by them. But they're tiny! How is this happening?

Desmond Lachman: The market has figured out that Greece is insolvent. They really can't address their budget deficit by the amount that the IMF is asking them to do without sinking their economy.

That means the market is realizing Greece can't repay the $400 billion of sovereign debt they've got. And then the bigger problem is that the markets are looking at Portugal and Spain and Ireland and the concern is that the European banking system is vulnerable to these crises because the European banks own these bonds. Spain has a trillion in bonds, and when you add Portugal and Greece and Ireland, you're talking $2 trillion. If there's a default on that, these bonds are in French, German and Dutch banks. So it's not just think rinky-dinky little economy, you're talking about the whole European banking system. Greece is like Bear Stearns. But there's a few Lehmans out there. And the question is, what happens if they come unstuck?"

Who can benefit from Greece crashing through the bottom and right back to the drachma? I've seen some speculation(and outright claims) that wealthy Greeks having been moving their money out of Athens so that when a drachma is reborn as the basis of the Greek economy, they can translate their hidden euros into drachmas except with a potential 40% markup, which is the expectation of devaluation that would hit Greece once it is out of the EU / eurozone controls.

UPDATE: Economist on the turmoil:

“It’s all very well for Papandreou to compare himself to Odysseus making a long, heroic voyage,” read one e-mail doing the rounds between Athenian offices this week. “But Odysseus had a miserable journey and he lost all his companions. And he washed up on Ithaca without any clothes on.”

"Riots, petrol bombs, tear gas and strikes greeted the Greek's government's latest attempt to persuade its citizens of the merits of reducing the country's budget deficit. In Athens demonstrators stormed up to the very steps of the parliament building, where an austerity plan was about to be debated, calling on the parliamentary “thieves” to come out. Three people were killed when protesters set fire to a bank building on Wednesday May 5th. Hours later, with tear gas drifting through the adjacent square, parliamentary leaders held a brief, sombre exchange on the signficance of the deaths, vowing to protect the principle that protest must be peaceful. Many citizens agreed that it was a sad moment for the birthplace of democracy.

Yet Athenians were also saying, with wistful smiles, that it had been a good party while it lasted. The backdrop to the riots was that, in a mixed mood of resignation, black humour and bitterness, Greeks were bidding farewell to a decade in which everything good and bad about their country grew feverishly.

...Harsh new taxes on business included in the government’s austerity plan may kill the entrepreneurial spirit of those bold enough to try new things. New taxes on business and property will also limit the attractiveness of state assets that the government may want to sell to raise revenue, notes Stefanos Manos, a former finance minister.

There is also a well-founded suspicion that light-fingered bureaucrats and greedy politicians, the very people who caused the crisis, will not be held to account. President Carolos Papoulias, a soft-spoken leftist whose office is meant to be above politics, reacted to the austerity plan with a one-sentence call for people who robbed the state coffers to be punished. Many agreed. “The wage and spending cuts will be implemented with great efficiency, but with our chaotic justice system, the pursuit of tax-dodgers and bribe-takers will just run into the sand,” predicted an Athenian architect.

“It’s all very well for Papandreou to compare himself to Odysseus making a long, heroic voyage,” read one e-mail doing the rounds between Athenian offices this week. “But Odysseus had a miserable journey and he lost all his companions. And he washed up on Ithaca without any clothes on.”

May 7, 2010

Germany votes for rescue package money for Greece

UK Mail Online - The maneuvering in the houses of European governance is paying off, so to speak, as the unpopular Greek bailout won approval in the German lower-parliament and will apparently pass the upper-house and go to the German president Horst Koehler for signature:

" German leaders today approved the country's share of the rescue package for debt-laden Greece after a boisterous debate in which the finance minister told them they had no alternative to the unpopular measure.

The lower house of parliament voted 390-72, with 139 abstentions, to authorise granting as much as 22.4billion euros (£19.5billion) in credit over three years.

That is part of a wider 110billion euro (£95.5billion) package backed by eurozone members and the International Monetary Fund.

...EU leaders have insisted for days that the Greek financial implosion was a unique combination of bad management, free spending and statistical cheating that doesn't apply to any other eurozone nation, such as troubled Spain or Portugal.

They said the bailout should contain the problem by giving Greece three years of support and preventing a default when it has to pay 8.5billion euros (£7.3billion) in bonds coming due on May 19.

Many Greeks realise some cutbacks are necessary to pull their country back from the brink of default, and reaction until now had been relatively muted by Greece's volatile standards.

But with people beginning to feel the pain of austerity measures, anger boiled over yesterday.

Riot police responded to protesters with stun grenades, flash bombs and volleys of tear gas that left clouds of smoke wafting over the capital.

There were also riots in the northern city of Thessaloniki, amid a 24-hour national strike which saw flights grounded, trains and ferries suspended and public services paralysed.

In the most horrific incident, 20 terrified staff were trapped in the burning Marfin bank after it was firebombed by protesters. The mob blocked firefighters from getting to the blaze."

This BBC article by Malcolm Brabant suggests the only way out of the mess is to restructure payment on the Greek debt (make 5 year bonds 10 years bonds - which is similar to what the IMF originally proposed and had rejected by the eurozone members who are trying to protect their banks who hold the bonds). The economic crudity of the austerity programs is causing so much social havoc, Brabant seems to say, that some form of compromise will appease the violence that is on the streets. He doesn't mention what the odds are that Greece can get Europe to go along with this:

"There is little doubt that the Greek police lost control of the streets on Wednesday, despite a promise by the Citizens' Protection Minister, Michalis Chryssohoidis, that he would never again allow Athens and other cities to burn, as they did during the riots of December 2008.

The aggressive tactics that were prevalent in Athens in December 2009, during the anniversary of the previous year's social uprising, were toned down on Wednesday - although there were some fierce clashes with rioters who hurled petrol bombs and chunks of marble at the police as they repelled an attempt to storm parliament.

There will be fears that Greece will be incapable of forcing through the austerity measures if the demonstrations continue.

"This is a country that up until 1974 had a military dictatorship and people are extremely sensitive to the police presence," said John Psaropoulos, a former newspaper editor and independent analyst.

"Right and left wing governments have handled the police presence very carefully. The biggest unions in the country together control, they say, about three million workers, which is about three quarters of the workforce in this country.

"There's no way to prevent them from doing what they did yesterday, at least peacefully. The trouble is that will create an environment for criminal acts on the sides, the government just has to live with that and handle it the best it can."

Washington Post - Column by Matt Miller examines the doom (probably) coming to the many politicians who are now cornered into making unpopular economic decisions to keep their respective countries or cities from sliding off a cliff into chaos and ruin. Miller starts off with Greece (of course) but points out that the spectacle is being repeated on a smaller scale in many other places:

"Greece's union leaders hope today's general strike (which has left three dead at this writing) will paralyze the country. Sounds like a brilliant strategy -- as if the country weren't already crippled enough by having to borrow $145 billion on awful terms to avoid bankruptcy, why not show your creditors you'll do everything in your power to renege on a pledge to restore fiscal sanity?

But labor's confusion aside, Greece's dilemma points to a pervasive trend. Does anyone think Socialist Prime Minister George Papandreou, who campaigned last year on pledges to boost pay and pensions for public-sector workers while hiking taxes on the rich, relishes the austerity plan he's agreed to implement? Papandreou is about to hike the top VAT rate to 23 percent, raise taxes on fuel, alcohol and tobacco, and cut public-sector wages and pensions. Did Papandreou want this to be his agenda?"

San Francisco Chronicle article by Stephen Simpson on the crisis: has a simple to follow timeline of events that went into the creation of the debacle, and then follows with editorial on what it will mean for the future:

"For Greece, this crisis is going to mean a major change in the standard of living over the next few years, with wages and economic activity likely to be down for a number of years. Ultimately, the hope is that Greece can reduce its deficits and debts to a more sustainable level and rejoin the public financial markets. In plain(er) English, Greece is basically going to be in a severe recession (if not depression) for several years.

Europe is clearly going to see the biggest short-term effects from this Greek meltdown, as roughly 70% of Greece's sovereign debt is held outside the country - much of that in France and Germany. That, in turn, is going to significant hurt those banks holding the debt and could force them to raise capital and curtail lending to rebuild their solvency. As that happens, there will be less money to loan to companies and individuals. The bottom line? Less growth across the continent.

On a more positive, if cynical, note, the bailout being offered to Greece should help protect the banks. In effect, the governments of Europe are choosing to have all of their taxpayers chip in to keep its banks and large financial institutions on firmer footing."

Kathimerini editorial on the frustration engulfing the political process in Greece as minor political parties struggle to stay away from the expected stigma from being associated with voting for the austerity programs:

"Yesterday was a time for Greece’s politicians to assume their responsibility. Unfortunately, many of them failed to respond to the crisis facing the nation.

Parliamentary deputies from across the country’s left-right ideological spectrum were called upon to decide between an extremely unpopular economic stabilization program, which includes a series of austerity measures necessary to pull the economy out of the fiscal hole into which it has been plunged and avoid bankruptcy.

True to form, the country’s main left-wing parties, the Greek Communist Party (KKE) and Coalition of the Radical Left (SYRIZA), chose the path of blanket rejection, claiming that there is another way to guide the nation out of the impasse."

More from Kathimerini on the profile of the violent rioters who've been all over the news following the arson and murders in Athens:

Emigration returning to Greece? This article at the BBC focuses on the renewal of an age old problem that has plagued troubled economies of Europe in the past, the exodus of the young: "Thousands of Greeks are facing this dilemma - do they stay and suffer austerity and unemployment, or become the next generation of large exiled Greek communities in Australia, Britain or the US?""TV stations have made the hoodies the protagonists of the day...

...This is an appealing package for the country’s restless youth who feel trapped in a bleak present and face an uncertain future. Clashing with riot police has become the only way for them to be in the limelight, albeit with their faces hidden.

The distance between romanticism and nihilism is much less than it appears to be.

Many are happy with the theory that the hoodies are little more than a group of provocateurs and agents of the police. What a nice way to circumvent the problem. It is not unlikely that there are certain people that fit this description among the hooded gangs, but it is a mistake to explain the phenomenon as a conspiracy. "

May 6, 2010

Somber mood prevails in news reports following deaths

Kathimerini - An editorial ("The road to destruction") asks many of the same questions that have been asked for years as the reality of the financial crisis has become more real. A difference made apparent by the deaths of May 5 is that the idea of a complete crash of the Greek system; social, political and financial, is now being considered.

"Greece is at the most crucial point of its post-1974 history and whether we destroy ourselves or not, whether we go bankrupt or not, depends not just on our political leadership, but also on every single one of us individually and collectively."

The Greek tolerance for political violence might have reached its limit. Neo Kosmos has a summary report on the events around the three deaths:

"The three deaths, two women and one man, appear to be from asphyxiation as the building was set alight from Molotov cocktails. This is an unprecedented development that has shocked the country and likely to mark a watershed regarding the use of petrol bombs by protesters. Most of the clashes by late afternoon were by splinter groups (some of whom smashed shop windows in various parts of the city centre) much to the disappointment and anger of the majority of demonstrators who were hoping for a firm and unequivocal expression of anger and disillusionment at recent developments."

Bad to Worse: Maybe much, much worse

The New York Times contemplates the effects of the Greek "rescue package" coming from the IMF and the eurozone and sees a 'sharp recession' a very real possibility, and a return to economic growth in 2012 quite unlikely:

" Daniel Gros, an eminent economist on euro zone issues who is based in Brussels, has argued that for each 1 percent of G.D.P. decline in Greek government spending, total demand in the country falls by 2.5 percent of G.D.P. If the government reduces spending by 15 percent of G.D.P. — the initial shock to demand could be well over 30 percent of G.D.P.

Obviously this simple rule does not work with such large numbers, but it illustrates that Greece is likely to experience a very sharp recession — and there is substantial uncertainty around how bad the economy will get. The program announced last weekend assumes the Greek G.D.P. falls by 4 percent this year, then by another 2.6 percent in 2011, before recovering to positive growth in 2012 and beyond.

Such figures seem extremely optimistic, particularly in the face of the civil unrest now sweeping Greece and the deep hostility expressed toward the country in some northern European policy circles."

The article goes on to point out that trying to save Greece from sudden default is the goal, but eventual default is considered a real possibility. The main effort by the Europeans is to keep the Greek disaster from spreading into other weakened countries (Portugal, Spain, etc) which might ramp up collapse for countries not currently at risk but who are carrying heavy debt-ratios against GDP (Austria, Belgium, even France...)

The surprising element here is the refusal by the Europeans to consider the IMF idea of simply restructuring Greek debt. The NY Times piece points out the obvious: if investors see that Greek debt could be reduced to a 50% balance, Portugal, Spain, italy, etc., will immediately reach for the same deal and investors will certainly flee from all but the strongest economies (e.g., the Germans).

The piece maps out a solution that would include Greek restructuring (and maybe Portugal, too. Spain is assigned the task to 'muddle through'). Devalue the Euro to match the US Dollar, and replacement 'en masse' of bank management throughout the EU. Careful steps are suggested on how to reach each of these goals, but it seems like an impossible scheme. These banks are a part of what is powering the current eurozone effort which in effect just cycling money from their home countries right back to their home bank balance sheets.

Here comes the money

Reuters details the evolving plan for the eurozone and the IMF to start handing over money to the Greeks (which will then be immediately used to pay maturing bonds held by the banks of many of these same European countries...)

"...the European Union's executive European Commission said Greece would get the first funds before May 19, when it has to repay 8.5 billion euros of maturing debt, because by that time a critical mass of funds would be available.

While no euro zone country can be forced to lend to Greece, no country can block others from lending either, the European Commission has said. Therefore a delay or even a parliamentary problem in one country does not stop the process in others.

Below is an overview of how much donors would contribute, dependent on their shares in the capital of the European Central Bank, and the legal hurdles the loans face:

IMF - up to 30 billion euros; the International Monetary Fund's executive board will meet on Sunday, May 9, to act on Greece's request for a $40 billion standby arrangement, a fund spokesman said on Tuesday. The IMF is fast-tracking financial aid for Greece.

GERMANY - 22.33 billion euros. Through accelerated parliamentary proceedings, Germany wants to approve a law to lend to Greece on Friday, May 7."

Live cam shot of Athens from the south, From http://www.pireas.gr/

May 5, 2010

Mass strikes, Arson and Deaths in Athens as Austerity Talks Continue

The protests against the Greek government austerity plan turns to violence and murder when a firebomb assault on a central Athens area bank killed three people. Between ten thousand to one-hundred thousand people gathered in Athens for the planned May 5 protest demonstration. Wall Street Journal reports on the deaths and the eight fires set downtown:

"The three died in a fire at central Athens' Marfin Bank and four other people were seriously injured there, fire department officials said. Panagiotis Papapetropoulos, a police spokesman, said eight fires in Athens office buildings and bank buildings had been brought under control. He offered no further details on the fatal fire as the investigation was just beginning.

Greece's bank workers union, OTOE, said it would stage a 24-hour strike Thursday in memory of three people who were killed. The union said the three were employees at Marfin Bank.

Greece's government, facing spiraling borrowing costs and a debt payment this month that it can't meet, is scrambling to pass through legislation implementing a three-year austerity and reform program it agreed to as part of the loan deal with the EU and IMF. Parliament is expected to vote as soon as Thursday on the measures.

...According to unconfirmed estimates, the number of protesters in Athens could have topped 100,000. Police officials put the figure at 20,000, while the GSEE and Adedy unions said a total of 50,000 took part in their protests alone. The communist-backed PAME union, also on the streets Wednesday, drew at least an additional 10,000 demonstrators.

"This rally was double the size of the largest rally that has ever been held in Greece," said Spyros Papaspyros, president of Adedy, a civil-service umbrella union. "Tomorrow afternoon, we will also be holding a protest in front of parliament, and if the government doesn't listen, there will be more strike action next week."

The front page of the Kathimerini news site headlined that the deaths were from a molotov cocktail firebomb. Kathimerini also carried estimates of up to 100,000 people active in the demonstrations of May 5. Read babelfish english translation of Kathimerini pages.

The web site Monsters and Critics has a large gallery of on-the-street photography showing Greek police trying to deal with the riots and protests. Story is credited to James Wray, photos credited to EPS/Panagiotis Moschancdreou. The site says over 20 people were hospitalized due to the firebomb attack.

"Murder!" Says Papandreou

The Associated Press / Google quotes Papandreou as angrily denouncing the violence for the deaths that occurred, declaring them 'murders. The AP story is credited to Derek Gatopoulos and Elena Becatoros:

"A demonstration is one thing and murder is quite another!" Prime Minister George Papandreou thundered in Parliament during a session to discuss the spending cuts he announced Sunday — measures even the IMF has called draconian. Lawmakers held a minute of silence for the dead — the first deaths during a protest in Greece since 1991.

A senior fire department official said demonstrators prevented firefighters from reaching the burning building, costing them vital time.

"Several crucial minutes were lost," the official said, visibly upset. "If we had intervened earlier, the loss of life could have been prevented."

Saw this note at the Living in Greece Blog:

"Rioters felt justified in burning Greece when police killed a boy in 2008. What shall we do to them, now that rioters have killed three?"

Are the violent images accurate?

This article at the UK Guardian by Kat Christofer suggests not taking the violent images being snapped by the international press as being the true story of what is going on in Greece:

"The photos and footage often accompanying stories about strikes in Greece can give the impression that revolution is under way. But beneath the hoods and helmets of stone-throwing youths are not militants, leftwingers, rightwingers, anarchists or even protesters. They're troublemakers, not unlike football hooligans, who grab the spotlight by intentionally hovering on the fringe of otherwise peaceful demonstrations to engage police in recreational violence, attack bystanders, throw Molotov cocktails and sledgehammer an innocent shopkeeper's livelihood, then retreat at the first sign of rain, cold or defensive action. Hardly heroic or hardcore, but a few minutes of violence make more exciting coverage than hours of pensioners carrying signs."

"...In a country dependent on tourism, which accounts for 18% of GDP, what trade unions have accomplished by striking is worse than nothing. Statistics show that 1.8 million tourists steered clear of Greece compared to 2009, either choosing a neighbouring Mediterranean country or staying home, resulting in €1.6bn in lost revenue."

Did Greece "Fudge" its economic numbers (or not?)

The standard description of the key elements of how Greece and the EU have reached this crossroads of financial disaster rests partially on blaming the Greeks for faking statistics about the country's economy. The idea being that blame rests solely in Athens and that the European powers that be (whose banks were eagerly loaning money to Greece) were completely blind sided when the truth finally came out. 'Not entirely true' says this article by Dan Bilefsky at the New York Times:

"...By 2004, it was clear that the Greek economic data was faulty. The European Union opened its first investigation into Greece’s deficit. Despite evidence compiled by Eurostat, the union’s official statistics agency, that Athens had fudged its numbers, European officials made clear that ejecting Greece from the euro zone was not an option.

Mr. Papantoniou, the former finance minister, blamed the discrepancy in the deficit figures on a change of accounting rules under the center-right government of Kostas Karamanlis, who came to power after the Socialists were ousted in March 2004 and altered the way military spending had been calculated.

“It’s a big lie that the Greeks falsified the statistics,” he said.

Tommaso Padoa-Schioppa, a former executive board member of the European Central Bank, recalled that after questions arose about the accuracy of Greek financial data, many countries shot down attempts to strengthen Eurostat’s oversight powers

“The fact is that an opportunity was lost at the time,” he said. “Greece is to blame for its poor management of public finance and competitiveness. But the peers have to be blamed for not doing their job sufficiently well.”

Also see the "Debt Map of Europe" the NYT has online. A graphic chart gives a perspective a list of numbers does not.

May 4, 2010

What will happen?

Protests, strikes and demonstrations in Athens has been a constant since the first crumblings of the Colonels in 1973 (and before the Junta when Greece had a king, 1967 and before). With the upheaval that's being set to come down on every Greek head from a government desperate to find away out from under default (and possible expulsion from the EU), there's a lot of blame being spread around, along with a growing fear about how hard the economic days ahead could be.

This is also a tough time for tourists. Some cruise ships are being turned away at Pereas, and other visitors already in Athens are finding much of what they came to see closed or operating under limited schedules. (To get a broader sense of what is and isn't open, look at this article at Living in Greece). This might seem a superfluous matter for most countries, but the Greek economy gains approximately $30 billion USD per year from the nearly 17 million visitors who come to Greece, and almost 20% of the work force is directly involved in the service industry supporting Greek tourism. Each day tourism is shunted aside to allow for the wrestling between the unions and the Greek government is a costly affair for independent businesses trying to make a shrinking economy stay afloat..

For how the striking is effecting Athens, see this list (Living in Greece) (I think it is instructive to note taxi cabs are not striking!):

Athens public transport: No Athens buses, no tram, no trolley, no proastiakos (suburban railway), no metro (red and blue lines), no electrikos (green line of metro; ISAP) except during the hours of 10:00-16:00 to accommodate protesters. Taxi cabs are not on strike.

The Triumph of the Euro (forbes.com) By Brian S. Wesbury and Robert Stein:

"With local interest rates soaring to 10% and even air force pilots on strike, it looks like Greece is going to get the financial aid it's been asking for--in the form of about $160 billion in loans over the next three years from the European Union and International Monetary Fund. Without these loans, it is doubtful Greece would have been able to rollover its debt at any interest rate. Greece would have defaulted.

By contrast, if Greece still used the drachma instead of the euro, we all know how its fiscal profligacy would have ended: with a major devaluation of the local currency and higher inflation. With a devaluation, everyone would have taken a haircut--including those who earned wages and salaries in drachma (in the public and private sector alike) and domestic or foreign investors locked into earning drachma-denominated interest or investment returns from bank deposits, government and corporate debt, or equities.

But since Greece uses the euro, devaluation is not an option. As a result, Greece's pain will be concentrated in the sector that is causing most of the problem: government."

Greek Bail-out "Making Matters Worse" (reason.com) By Tim Cavanaugh:

The $146 billion bailout package approved this weekend for Greece is advertised as a move to "stop the worst crisis in the [euro]’s 11-year history," but it is having exactly the opposite effect.

"We have to keep the money flowing or these people might go commie. First, the bailout, which effectively kicks Greece's pending default forward, has not solved the problem that the cost of debt service for the PIIGS countries is increasing. That's in part because this is not actually a problem. The question is not why Greece has to pay such a high yield on its bonds but why Portugal and other on-deck defaulters have to pay so little. The bailout was supposed to put debt buyers at ease about Europe's overleveraged states, but because it only allows these countries to take on more debt, it has not.

...the move has only irritated German and French voters who are outraged at having to pay for the wastrelsy of a country that, it is now clear, should never have been a euro participant in the first place. Elections rarely turn on foreign affairs in any country, and the Financial Times' Quentin Peel makes the case that the Greek bailout will not have a big impact on this week's vote in North Rhine-Westphalia."

Major strikes occurring throughout Athens (BBC):

"Greek public sector workers, who are bearing the brunt of wage and pension cuts as part of Greece's austerity programme, have begun a 48-hour strike. Their action comes ahead of a nationwide general strike on Wednesday. The austerity measures are being submitted in a draft bill to the Greek parliament and will be voted on by the end of the week. "

Austerity measure being implemented (and protested):

- Scrapping bonus payments for public sector workers

- Capping annual holiday bonuses and axing them for higher earners

- Banning increases in public sector salaries and pensions for at least three years

- Increasing VAT from 21% to 23%

- Raising taxes on fuel, alcohol and tobacco by 10%

- Taxing illegal construction.

Europe "losing it's patience with Greece"? (AFP-Google):

"Europe is losing patience with Greece, Austrian Finance Minister Josef Proell said, as a new wave of protests against government austerity measures in Athens loomed.

"Regarding the protests in Greece, I, along with the rest of Europe, am near the end of my tether," Proell said late Monday after the eurozone endorsed a huge rescue package to pull Athens out of a debt crisis.

Greece's government must make it clear to the population that austerity measures are absolutely necessary to help the country emerge from its crippling debt, he urged."

The Actions of a Few (kathimerini) editorial:

"...close to 1,000 tourists on a cruise ship lost a day of their vacation when Greek unionists, protesting planned legislation that will allow cruise ships with foreign crews to dock in Greek ports, stopped them from embarking in Piraeus. This prompted the Spanish cruise company to warn that it may suspend visits to Piraeus. If this occurs, at least 1,000 tourists per week, who are by definition in a high income bracket, will no longer visit Athens as part of their Mediterranean cruise. They will not eat at Plaka's restaurants, visit our museums nor buy souvenirs. This loss is not likely to affect the unionists who probably count every new injury to the Greek economy a trophy in their war against capitalism. But it does show how the actions of a few can affect the livelihood of many. "

May 2, 2010

"Three-Year Lifeline"

The financial crisis keeps pounding away at the Greek psyche. The Living in Greece blog has a list of austerity cuts that are being put into effect, some not too surprising: luxury, "sin" and VAT taxes are all jumping by 10%, the much maligned holiday extra-payments are going to vanish except for those paid low salary amounts, and early retirement is also going out the window.

Although the bail-out is starting to look like a certainty, there is some Germon opposition that has to be overcome.

Rescue Package still faces German Hurdle (Reuters)

"European finance ministers triggered a record 110 billion euro ($147 billion) bailout for debt-stricken Greece on Sunday after Athens committed itself to years of painful austerity.

After weeks of tough talk and procrastination due to fierce public opposition to handouts for the Greeks, German Chancellor Angela Merkel finally threw her full support behind the EU/IMF package, vowing to fight for parliamentary approval by Friday.

...Underlining the challenge facing Merkel, German politicians voiced reluctance to approve the rescue. Social Democratic opposition leader Frank-Walter Steinmeier said his party would take a lot of convincing to support the bailout.

A conservative ally of Merkel demanded that Athens be put under stricter tutelage by sending a European Commissioner to oversee spending cuts and accounting. "We can't give Greece any blank cheques," said North Rhine-Westphalia state premier Juergen Ruettgers, who faces election defeat next Sunday.

The Greek rescue dwarfs the previous record bailout. South Korea -- a country with a population nearly five times that of Greece -- obtained a $58 billion rescue package from donors including the IMF during the Asian financial crisis in 1997."

Greece with a European gun to its head (New York Times) By Steven Erlanger

"...there are serious questions about whether the deep cuts in salaries and benefits the agreement calls for are politically sustainable over time, even as deflation will make it impossible for Greece to grow its way out of debt.

"... Embedded in the euro and thus no longer in control of its own currency, Greece cannot take the easy way out of its debt by devaluing. So Greece must either cut its spending sharply or default on its loans — which would badly damage German and French banks carrying a lot of Greek debt.

That is considered one reason President Nicolas Sarkozy of France has been so quiet on the Greek crisis, Mr. Fitoussi said. The Greek deal “is an indirect way of bailing out French and German banks,” he said. “The French understood this from the start, but Germany didn’t seem to.”

$146 USD Billion Rescue Package (Bloomberg.com) By Gabi Thesing and Flavia Krause-Jackson:

"Euro-region ministers agreed to a 110 billion-euro ($146 billion) rescue package for Greece to prevent a default and stop the worst crisis in the currency’s 11-year history from spreading through the rest of the bloc. The first payment will be made before Greece’s next bond redemption on May 19..."

"...It is not an easy day,” said Finance Minister George Papaconstantinou in Brussels. “It’s not going to be easy for Greek citizens. But it’s absolutely clear that the Greek government is prepared to do what it needs to do.”