Greece News

April 20, 2024

Concern for weather turning worse

Story at Iefimerida [Greek]

Sheep flock gets rustled, then things go wrong for the thieves

Story at Bloko [Greek]

S&P gives positive rating to Greek economic outlook

Story at Reuters [English]

The plan to protect beaches

Story at NY Times [English]

Rain hit Volos, Pelion and Karditsa hard

Story at Skai [Greek]

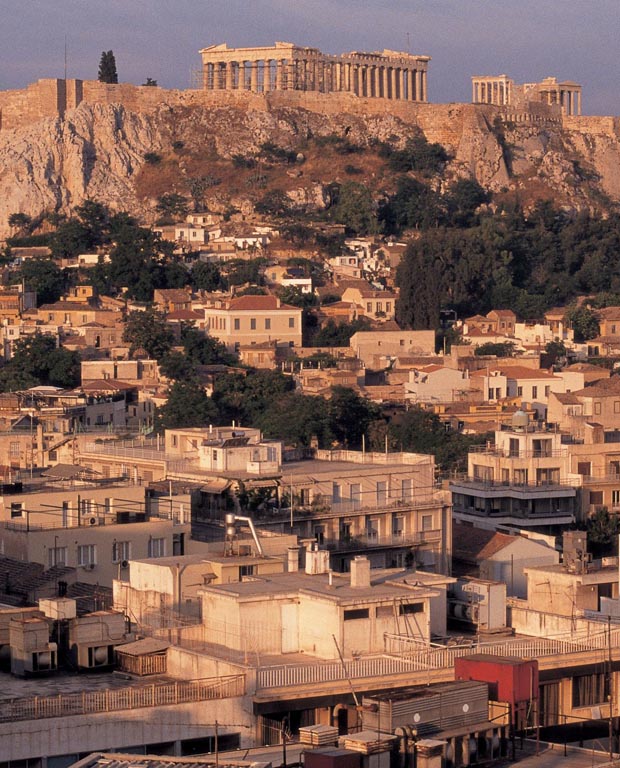

After "world’s longest recession" Greece came back

...Greece was all but eradicated as a functioning economy by a sovereign debt crisis in 2009-10 that led to fears of a default and of this small, southern European economy bringing down the whole eurozone...."

Story at UK The Times [English]

April 19, 2024

Mitsotakis personally welcomes 92 Turkish tourists to Mytilini

Story at Skai [Greek] [Map of Mytilini]

Special meeting of Risk Assessment Committee due to expected bad weather ahead

Story at Skai [Greek]

Israel strikes back at Iran

Story at Kathimerini [Greek]

The trouble finishing municipal projects in Thessaloniki

Story at Protothema [Greek]

Juvenile delinquency and the massive number of recent arrests

Story at Bloko [Greek]

"Eye for an eye" say Israeli officials about Iran attack

Story at Liberal [Greek]

Greece - Albania and who is always right?

Story at EFSYN [Greek]

With turmoil in global economy, can Greece go against the tide?

Story at Naftemporiki [Greek]

Timeless Villages, Scenic Hikes, Local Flavors - Moon's Greek Islands & Athens Travel Guide – Amazon 560 Pages

April 18, 2024

Erdogan and Mitsotakis to meet next month in Ankara

Story at Greek Reporter [English]

Property taxes in Thessaly for flood victims

Story at Keep Talking Greece [English]

Kasselakis removes Dimitris Papanotas from SYRIZA

Story at Iefimerida [Greek]

Beleris is named as candidate in EU election

Story at Fox News [English]

The reactions to the marine parks in the Ionian and Aegean Seas

Story at shshs [Greek]

"Only a matter of time" until Israel strikes Iran

Story at Eleftherostypos [Greek]

Why the prices on gas has increased so much

Story at Protothema [Greek]

Ankara reacts to Mitsotakis announcement of marine parks in marine parks in the Ionian and Aegean seas

Story at Skai [Greek]

Mourning the loss of the policeman who died in the Piraeus building collapse

Story at Eleftherostypos [Greek]

The Council of State put an end to the "recumbent apartment buildings" on Amorgos

Story at Kathimerini [Greek]

Russia mounting stronger attacks on Ukraine

Story at Skai [Greek]

EU better competition through more integration

Story at Powergame [Greek]

April 17, 2024

Greece acquiring Iron Dome style anti-drone and anti-missile defense system

Story at Eleftherostypos [Greek]

Retroactive pensions decision coming

Story at Ta Nea [Greek]

Hamas sends thanks to "brother Erdogan"

Story at Skai [Greek]

Effects in Athens traffic from strike

Story at Parapolitika [Greek]

The Wednesday strike across Greece

Story at Ethnos [Greek]

Israel closer to response to Iran attack

Story at Naftemporiki [Greek]

Serious complaints about psychiatric hospital in Athens

Story at Ethnos [Greek]

Greece-Turkey meeting in Athens on April 22

Story at Athens News Agency [Greek]

Mitsotakis links ND strength to Greek stability

Story at Athens News Agency [Greek]

Fatality in the collapse of building in Piraeus

Story at Eleftherostypos [Greek]

The paradox in polling: ND dominance is unshakable and discontent is not harnessed by the opposition

Story at Liberal [Greek]

The standard of living has fallen

Story at EFSYN [Greek]

Time to go to Disney World? Goofy 4 Mickey

Laughter with Comic Books and Cartoons comicatomic