Greece News

Air Conditioned spaces for tourists and locals to "cool off" in Athens

July 18, 2025 Friday

Why electrical prices in Greece remain above the average

Story at Capital [Greek]

Mitsotakis we want to see how AI can make governing better

Story at Naftemporiki [Greek]

Trolleybuses of Athens to be withdrawn

Story at Greek Reporter [English]

Petros Filippidis apartment fire "likely arson"

Story at Iefimerida [Greek]

Temps lower and "breezy winds" but significant hot temps ahead

Story at Athina984 [Greek]

Erdogan has confirmed that Turkey has acquired two seaworthy hydrocarbon exploration drilling rigs

Story at Parapolitika [Greek]

New phone evidence of the murder at Agia Paraskevi

Story at Iefimerida [Greek] [Map of Agia Paraskevi]

"Mega-deal" coming from Zelensky and Trump?

Story at Naftemporiki [Greek]

Deputy Minister of Infrastructure and Transport Konstantinos Kyranakis pledges implementing new railway safety measures "now"

Story at Parapolitika [Greek]

Where do celebrities vacation?

Story at Eleftherostypos [Greek]

Greece's "Digital Nomad" visa

Story at NDTV Lifestyle [English]

July 17, 2025 Thursday

Death of three Chinese nationals from head-on collision with truck

Story at Athina984 [Greek]

Major crackdown in Kolonaki over pedestrian obstructions

Story at Protothema [English]

Deputy Minister of Transport Konstantinos Kyranakis and KKE General Secretary Dimitris Koutsoubas argue in parliament after comment about "death trap" roadway crossings

Story at Parapolitika [Greek]

Video evidence of the murder at Agia Paraskevi

Story at Iefimerida [Greek]

White washed buildings in Naoussa on the shoreline of Paros – click image to enlarge

How long will this heat wave last?

Story at Real [Greek]

Chevron's continued involvement in hydrocarbon exploration with Greece seen as huge expression of confidence in Greek state

Story at Imerisia [Greek]

45º Celsius / 113º Fahrenheit temps hitting Greece and Turkey

Story at MSN Coventry Live [English]

Libya submits map to UN which shows claims close to Crete

Story at Kathimerini [Greek]

Polling shows that, despite OPEKEPE scandal, New Democracy maintaining strong numbers

Data at Iefimerida [Greek]

How everything has changed in the OPEKEPE scandal

Story at Naftemporiki [Greek]

Ancient Roman aqueduct being brought back to life

Story at National Geographic [English]

Childhood of alleged multi-murderer Irene Mourtzoukou

Story at Parapolitika [Greek]

Murder of visiting Berkeley professor leads to ex-wife's arrest

Story at MSN Los Angeles Times [English]

How the authorities got onto the trail of the murderers of the Berkeley professor

Story at Ethnos [Greek]

Amazon affiliate - when you use our links to Amazon, we might earn a commission.

Timeless Villages, Scenic Hikes, Local Flavors - Moon's Greek Islands & Athens Travel Guide – Amazon 560 Pages

Arrests made of three people connected to the 4.5 tons of cocaine seized in 2023

Story at Reuters [English]

Enjoying a perfect weekend on the Athenian Riviera

Story at Travel and Leisure MSN [English] – More about the Greek Riviera

How resilient is the global economy?

Story at IN GR [Greek]

Europe's shifting poverty rates

Story at MSN EuroNews [English]

Major fire in Iraq kills 60

Story at Athina984 [Greek]

ADVERTISEMENT

First-Timers Trip To Greece – AMAZON – Greece Travel Guide: How to Plan a Trip to Greece with Best Tips for First-Timers – 177 Pages • Proven strategies to efficiently plan your trip to Greece • friend's advice on what to see and do in Greece's charming cities and iconic islands • Handy tips on exploring Greece without emptying your wallet

July 16, 2025 Wednesday

New Ambassador Kimberly Guilfoyle approved by US Foreign Relations Committee

Story at To Vima [Greek]

Mitsotakis encouraging young people to relocate to country areas

Story at Protothema [Greek]

Confession from suspects over Agia Paraskevi murder

Story at Eleftherostypos [Greek] [Map of Agia Paraskevi]

Downtown Athens – July 16, 2025

Trump tariffs could hit Greece's peach harvest hard

Story at Reuters [English]

Attack on Druze city in southern Syria leads to Israeli strikes on Damascus

Story at Naftemporiki [Greek]

How exposed to Trump's tarifs is Greece?

Story at Greek Reporter [English]

Five being questioned in investigation of murder of visiting US professor in Agia Paraskevi

Story at CNN News [English] [Map of Agia Paraskevi]

The new refugee crisis

Story at Deutsche Welle [English]

Huge number of fines coming for uninsured vehicles, unpaid taxes, etc.

Story at Athina984 [Greek]

Former PM George Papandreou speaks on AI and what the ancient Greeks thought about it

Story at MSN Africa News [English]

Eurostat data shows only half of Greeks can fund a vacation for themselves

Story at Greek Reporter [English]

"The new era of using public property in Greece" – the reconstruction of Tae Kwon Do Faliro property

Story at Parapolitika [Greek] [Map of Tae Kwon Do stadium]

The New York meeting over the "Cyprus problem"

Story at Kathimerini [Greek]

How Italy, Spain, and Greece are pulling tourists from USA destinations

Story at MSN The Travel [English]

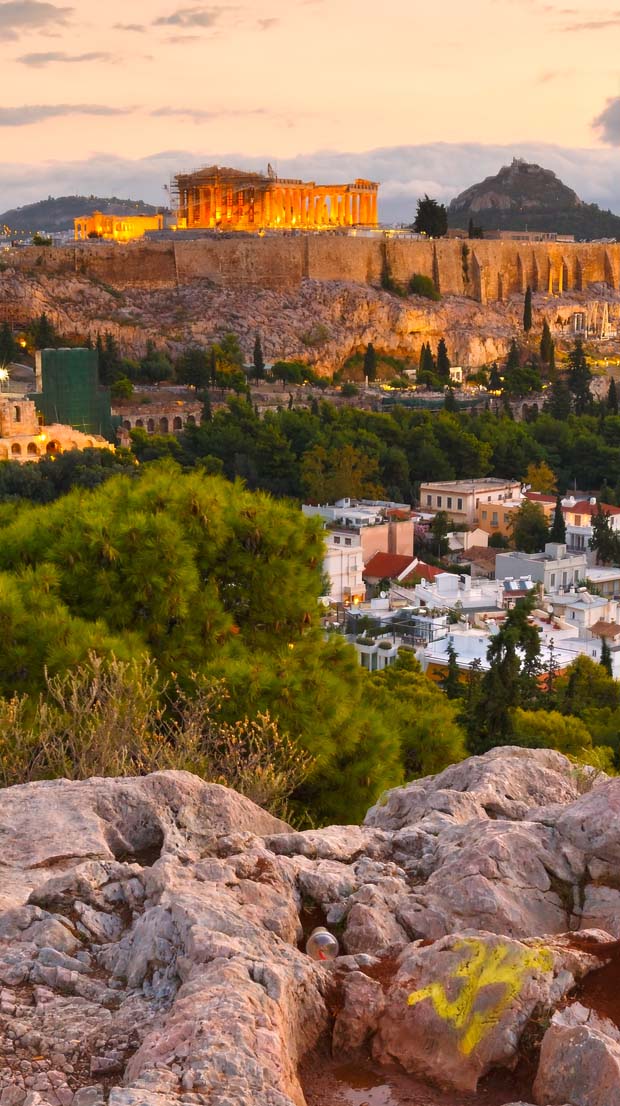

Parthenon and Acropolis as sunset comes into Athens, Greece

Updated! Pages on the Island of Rhodes and the Island of Kos

Time to go to Disney World? Goofy 4 Mickey

Laughter with Comic Books and Cartoons comicatomic

Belief-Code, Body Code and T3 Therapy? See Belief Code Therapy.com